How to Avoid Online Scams in 2025: Black Friday & Other Frauds to Watch Out For

As the holiday season approaches, the risk of being targeted by online scams increases. The best way to avoid scams is knowing how to recognize them. In this guide, we’ll look at the most common scams and how you can protect yourself online.

Online scams are rife during the holiday season, with scammers desperate to get hold of your information to access your bank account, Social Security number and other sensitive data. Though there are ways to boost your security, such as using 2FA and a top VPN to encrypt your connections, the best defense is knowing what a scam looks like.

Scams are increasingly difficult to detect — it’s easy to click on a link that takes you to a shady website or that installs malware on your device. We’ve created this in-depth guide focused on helping you spot common online scams so you don’t fall victim to identity theft or fraud.

-

12/12/2024 Facts checked

We’ve rewritten the article with an expanded list of common scams, and added more vital tips for avoiding scams.

Definition: What Are Online Scams?

Online scams are fraudulent schemes that take place on the internet. They’re designed to lure individuals into sending the scammers money or sharing personal or financial details. Scams can target anyone and are more prevalent during the holiday season. Scammers use tactics like phishing messages, fake sites and pop-up ads to find victims.

Types of Internet Scams

1. Black Friday Scams

Black Friday is a prime time for scammers, who will create fake websites, ads or social media posts with deals that seem too good to be true. If you fall victim to this scam, you may end up paying for counterfeit items or products that don’t exist, or might hand over your financial and personal data to the scammer.

2. Phishing Scams

Phishing attacks are fraudulent attempts to obtain personal data such as account logins or credit card details. They can appear as unsolicited emails or a text message claiming to be from official sources, requesting urgent account verification or promising an exclusive deal.

If you click the link, you may be directed to a fake login site and prompted to provide your details, which hackers can use for identity theft and fraud. Clicking phishing links can also download malware onto your device, like ransomware or keyloggers, even if you do nothing else after clicking.

3. Online Shopping Scams

Fake websites boom during the holidays, when customers turn to online shopping. Scammers make copycat sites that get shoppers to part with personal or financial information like passwords and card numbers. Scammers lure visitors with phishing emails or URLs that are a simple typo off from popular sites — a practice known as typosquatting.

4. Tech Support Scams

Scammers pose as technical support agents claiming to contact you from reputable companies like Microsoft or Apple. They’ll tell you there’s a critical error or malware on your device and pressure you to grant remote access, pay for fake repairs or download fake security software that installs ransomware or steals your data.

5. Dating and Romance Scams

In romance scams, a scammer sets up a fake profile on social media or a dating app, typically using images of someone conventionally attractive — also known as “catfishing.” As the scammer encourages a false romantic relationship, they will refuse to meet in person and demand money from their victim on various pretenses.

6. Cryptocurrency Investment Scams

A cryptocurrency investment scammer approaches victims with a “once-in-a-lifetime opportunity” to invest their money and get a high rate of return. Trust is built through social media posts or fake endorsements that sound convincing. Once you send your money, the scammer disappears and the investments turn out to be inaccessible or worthless.

7. Gambling Scams

Gambling scams involve promises of big wins, generous payouts or deposit bonuses when you sign up for an online casino account. However, the casinos are fraudulent, with games that are rigged to lose and a refusal to honor payouts should you win. Not only will you lose your money, but you’ll also give scammers personal information like your bank details.

8. Employment Scams

Fraudsters pose as potential employers, offering jobs with great benefits like flexible hours and high rates of pay. However, they might ask for details like your name, address and Social Security number for “onboarding purposes”; have you pay a fee in order to start work; or give you tasks to complete and refuse to pay.

9. Fake Loan Scams

Fraudulent loan scams target vulnerable individuals who may have difficulty getting a traditional loan. They’ll guarantee a loan with low interest rates, even if you have poor credit, and immediate transferral of funds to your bank account. They’ll ask for your personal details and usually charge a fee for the loan — but you’ll never get the money.

10. Gaming Scams

Scammers target the gaming community by creating fake valuable items, rigging in-game trades or faking “hack tools” to install malware on your device. They’ll ask gamers to share login information or pay real money to gain rewards and rare items. However, the items don’t exist, and the login details are used to steal data from the account.

11. Real Estate or Rental Scams

Real estate scams work by targeting victims who urgently need affordable housing. Scammers pose as landlords or create property listings that aren’t real. They’ll ask for your information and for a fee or deposit for the property before you can see it — only for you to discover that the listing was fraudulent.

12. Charity Scams

Charity scams involve scammers pretending to represent a legitimate charity to secure funds or personal information from potential victims. You might receive a phone call or text message, or see posts on social networking sites asking for monetary or material donations. However, these donations are used only for personal gain and won’t reach the charity.

How to Spot Online Scams: Examples

No matter how sophisticated online scams get, there are some simple ways to spot a scam and avoid identity theft and fraud. Watch out for the following clues:

- Offers and deals from unsolicited sources that are too good to be true

- Messages that are poorly written, with spelling and grammatical errors

- Language that creates a sense of urgency and pressure to act quickly

- Requests to share personal details or send payment

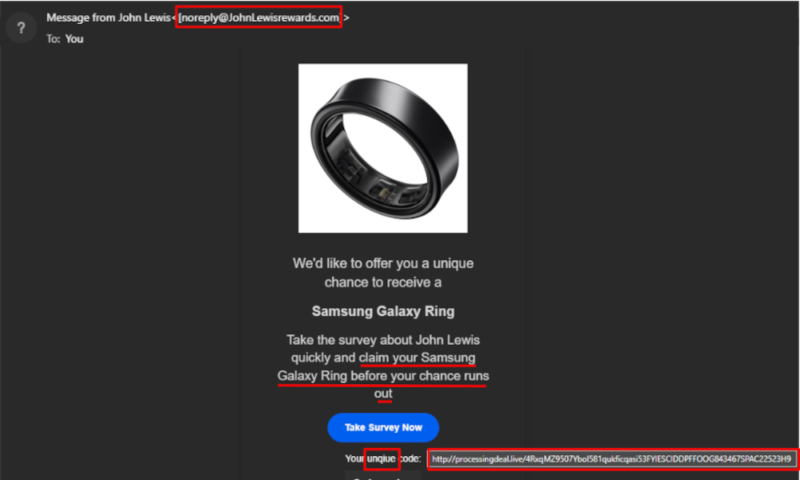

Online Scam Example: Phishing Email

Here’s an example of a fake email that encourages the recipient to click on a phishing link. The email uses an authentic-looking sender address, applies pressure to act immediately — “before your chance runs out” — and includes an odd external link and spelling mistakes. In a secure testing environment, the link was blocked by malware protection due to riskware.

source but has telltale signs of a scam.

In the image above, the email domain “JohnLewisrewards.com” is worded to look legitimate, but a quick check reveals that it’s not actually associated with John Lewis.

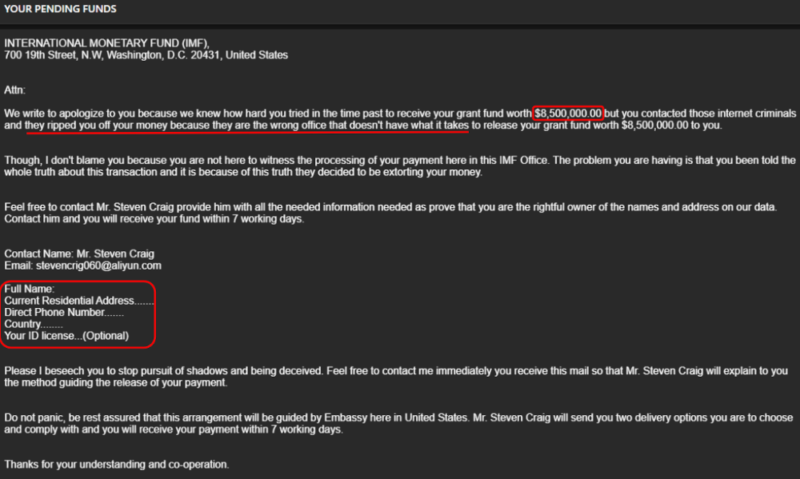

Online Scam Example: Funding Scam

This email is a great example of a deal that’s too good to be true — offering a huge amount of money from a fake grant fund in exchange for your personal data. The email is poorly written, with incorrect grammar, and doesn’t include a name in the greeting — clear signs of a scam.

details to claim from a fake grant fund.

How to Protect Yourself From Online Scams

Final Thoughts

We hope you’ve now got a solid understanding of the tactics fraudsters use to get you to part with your information and money. Remember to be on your guard, especially over the holidays — it’s the perfect time for scammers to strike.

Have you been the target of an online scam? Do you feel confident that you know how to identify online scams? How would you protect yourself from a scammer? Let us know in the comments and, as always, thank you for reading.

FAQ: Prevent Online Scams

To avoid being scammed when shopping online, make sure to use trusted and reputable websites and avoid deals that seem too good to be true. Use only secure payment methods such as a credit card to make purchases.

You may get your money back if you report the transaction to your bank or credit card company and dispute the charge as a scam. You can also report the scam to your local authority, which should have an agency for reporting scams, such as Action Fraud in the U.K. or the FTC (Federal Trade Commission) in the U.S.

A buyer may be trying to scam you if they offer to overpay and have you refund the excess amount — it’s likely the initial payment will fail or be charged back. If you’re using a selling platform like eBay, be cautious of buyers who want to make purchases off-platform or refuse to follow the terms of service.

You can find out if a company is legitimate by verifying the business credentials using a government or industry database. You can also research the company — look at the official website and note anything unusual (like a lack of secure payment methods or clear contact information) and seek reviews from trusted sources.