Identity Theft Statistics, Facts and Trends You Need to Know in 2026

Identity theft is one of the world’s most popular online crimes. As such, anyone can fall victim to it. Read our identity theft statistics guide to understand its impact and learn how to protect yourself better.

Identity theft, or ID theft, is one of those crimes that most people and businesses don’t think will happen to them until it does. Given the financial and emotional consequences of identity theft, it’s essential to be vigilant. Our identity theft statistics provide a thorough view of the many methods fraudsters invent to steal identities.

Identity theft occurs when someone steals your personal information with the intent to make fraudulent transactions. There are several types of identity theft, which include synthetic identity theft, child identity theft and social media identity theft.

These statistics cover topics ranging from the state of the identity fraud prevention market to the emotional consequences of identity theft and its future. To help you protect your identity more effectively, we also discuss security measures you can take. These include safeguarding your social security number, being vigilant about spoofing and phishing, and using strong passwords.

-

11/22/2021

Cloudwards checked all facts for accuracy and updated statistics from 2021 on identity theft with children.

-

03/15/2024

Rewritten to include the latest statistics about identity theft.

Identity Theft Trends & Facts

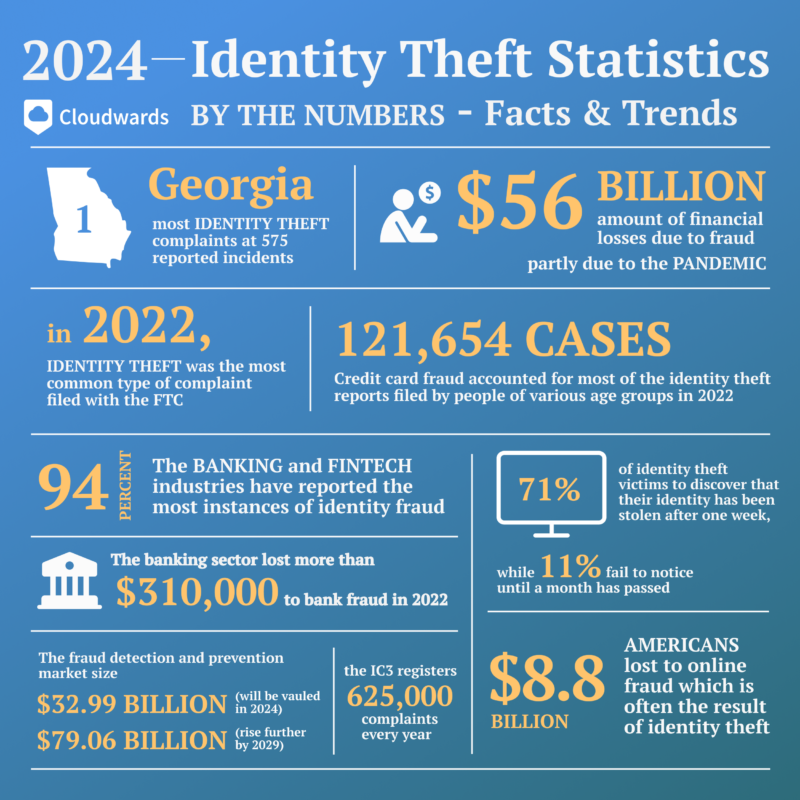

The following statistics give a general overview of the rise of identity theft, touching on the number of complaints per year as well as the pandemic’s influence on its growth.

1. On average, the IC3 registers 652,000 complaints every year.

The Internet Crime Complaint Center (IC3) is a division of the FBI that receives complaints from alleged victims of criminal or civil violations. These complaints address forms of cybercrime including intellectual property rights (IPR) matters, computer intrusions, economic espionage (theft of trade secrets), online extortion and more.1

2. Complaints about identity theft are on the rise.

The Federal Trade Commission (FTC) received over 1.1 million identity theft reports in 2022. The number of identity theft cases reported per year is expected to keep rising, as scammers identify more effective ways to exploit personal data.3

3. A 2023 survey found that 27% of U.S. adults have experienced identity theft on multiple occasions.

This result provides another indication of the diverse methods used to perpetrate identity theft, since the likelihood of falling victim to the same tactic more than once is low. For example, while identity theft sometimes occurs when fraudsters trick consumers into disclosing personal data, it can also occur due to online data breaches that catch the victim unawares.3

4. The pandemic was a leading cause of identity theft.

The aggregate amount of fraud losses was up $56 billion in 2020, and identity fraud scams made up $43 billion of that cost.4 Due to the lockdown that resulted from the 2020 pandemic, consumers had to rely more on e-commerce and online transactions, which often require the disclosure of sensitive information such as emails and phone numbers.

Demographics and Identity Theft Victim Statistics

Here are three key statistics about the demographics most impacted by identity theft.

5. Georgia tops the list of U.S. states with the most identity theft reports per 100,000 population.

Georgia had 457 reports per 100,000 residents in 2023. Florida had the second-largest number of reports (438) while Nevada came in third place (404).9 South Dakota had the lowest rate, with only 94 reports per 100,000 people.

6. A large number of U.S. residents aged 16 or older filed identity theft complaints in 2021.

Around 23.9 million people — or about 9% of all U.S. residents aged at least 16 years — said they had experienced identity theft in the past year, according to a 2021 report derived from the Identity Theft Supplement and the National Crime Victimization Survey.2

7. People aged 30 to 39 years old reported the most cases of identity theft in 2023.

People in this age bracket reported 272,971 identity theft cases. Those aged 80 and above had the fewest cases of identity theft, with just 8,901 sending in a report.9

This figure may have resulted from a false sense of security held by millennials, who grew up at the advent of the digital age. However, it’s also worth noting that some victims of identity theft may not report the crime due to feelings of embarrassment about being duped.

Most Common Types and Methods of Identity Theft

Identity theft takes various forms, but credit card fraud emerges as the most commonly reported method.

8. Identity theft was the most common type of complaint filed with the FTC in 2023.

The Federal Trade Commission (FTC) is an independent agency that ensures fair business practices and protects consumers. The FTC received a total of 1,036,903 identity theft reports (19.2% of all fraud reports) in 2023. The second most common complaint was imposter scam reports at 853,935 cases.

Credit bureaus, information furnishers and report users had the third most reported complaints filed with the FTC, which totaled 711,802 cases.9

9. Credit card fraud was the highest-reported form of identity theft across various age groups in 2023.

People aged 30 to 39 years reported 122,246 cases of credit card fraud. This was followed by people aged 40 to 49 years who reported 84,604 cases of credit card fraud. The third-highest number of reports came from those aged 20 to 29 years, with 71,900 cases.9

10. Phishing was a leading cause of data breaches in 2023.

Phishing is a form of cyberattack where an attacker tricks people into revealing their personal information by posing as a reputable agency or person. A data breach analysis by the Identity Theft Resource Center showed that phishing attacks were the most frequently reported cause of data breaches in 2023.10

Sector-Specific Identity Theft Statistics

This section provides an overview of how identity theft and fraud have affected some of the world’s top industries.

11. Banking and fintech are the worst-hit sectors.

The banking and fintech industries have reported the most identity theft cases, with 94% of organizations falling victim to fraud. Additionally, smaller banks experience a higher rate of identity fraud than larger banks.11 According to Forbes, this is because most smaller financial institutions lack adequate data and the operational resources to effectively prevent fraud.

12. The median bank lost over $300,000 to identity fraud in 2022.

The median bank had about $310,000 stolen by identity fraudsters in 2022, according to a global survey by Regula and Sapio Research.12

13. The personal data of 11 million HCA Healthcare patients was compromised in July 2023.

This breach exposed their names, dates of birth, emails and telephone numbers.3 Data breaches often release information that identity thieves can use.

Financial Implications and Losses

These statistics provide insights into the magnitude of financial loss that occurs due to identity theft.

14. Most identity theft victims suffer direct financial losses.

Over 57% of identity theft victims lost money as a direct result of their most recent identity theft incident in 2021. These losses totaled $16.4 billion.2

15. Identity theft can have significant financial consequences.

Americans lost billions of dollars due to online fraud (which most commonly results from identity theft) in 2022. According to the FTC, this loss amounted to $8.8 billion, with a $650 median loss. However, some private estimates exceed this amount by far.3

16. Identity theft is not only financially draining, but it can also be time-consuming.

The fraud resolution process for identity theft can last for over a month, according to the 2021 Identity Theft Supplement to the National Crime Victimization Survey.2

The Emotional and Psychological Impact of Identity Theft

The emotional effects of identity theft can be just as bad as the financial consequences.

17. Identity theft sometimes leads to severe emotional distress.

A 2021 survey of identity theft victims showed that 10% of them were severely distressed due to the crime.2 The shock of the event, coupled with the time spent resolving the issue, contributed to the emotional distress.

18. People who had more accounts compromised experienced higher emotional distress

In a 2021 survey, 18% of victims who had suffered identity theft incidents for multiple accounts reported “severe” emotional distress, compared to 8% of victims who only had one type of account compromised.2

19. The more time that victims spend on resolving fraud incidents, the more upset they tend to be.

A 2021 survey by the U.S. Department of Justice revealed that emotional distress was higher in identity theft victims who spent at least one month resolving the problem.2

Statistics on the Future of Identity Theft

The identity theft protection industry has continued to grow significantly, thanks to the emergence of cutting-edge technology.

20. The fraud detection and prevention market size will see substantial growth within the next five years.

Experts project that the fraud detection and prevention market size will reach an approximate value of $32.99 billion in 2024 and grow 19.1% per year to reach $79.06 billion by 2029.7 The high growth rate indicates the increasing motivation of businesses to reduce their risks through robust fraud detection solutions.

21. The global market for AI in fraud management will grow massively within the next decade.

According to Future Market Insights, the global market for AI in the fraud management market is anticipated to grow to $57,146.8 billion by 2033, at an annual rate of 18.5%.8 AI has impacted the fraud management industry significantly, boosting the efficiency of anomaly detection, pattern recognition and biometric monitoring.

22. The global biometric technology market will experience exponential growth within the next six years.

Biometrics refers to the use of biological characteristics to identify and authenticate individuals. Facial recognition, fingerprint mapping and voice recognition are some examples of biometric technology. Grand View Research forecasts that the global biometric technology market will reach a valuation of $150.58 billion by 2030, growing at 20.4% annually.6

5 Tips for Identity Theft Protection

Protecting your identity requires you to block access to all of the channels that fraudsters can use to find information on you.

Use Identity Theft Protection

Sign up for one of the best identity theft protection services. If you’re worried about expenses, then consider some of the best free identity theft services — it won’t provide as thorough coverage as the premium plans, but some protection is better than none.

Protect Your Social Security Number

Getting hold of your social security number allows an identity thief to access your personal data through multiple channels. To prevent this, ensure that you only give it to trustworthy parties and verify how it will be used. Memorize your social security number. Then store paperwork containing your social security number in a safe place or shred any documents that aren’t needed anymore.

Watch Out for Phishing and Spoofing

Phishing and spoofing are both ways through which scammers can defraud people, and they are often used in tandem. Phishing tricks the victim into revealing their personal information, and spoofing involves forging information, such as emails or phone numbers, to make the user think that a message is from a trusted source.

To avoid becoming a victim of these crimes, always confirm the contact details of businesses and other institutions by checking their websites (and make sure you’re on the right website). Also, educate yourself on what phishing is and the tricks that are typically involved, such as creating a false sense of urgency through vague but frightening details.

Use a Password Manager and Enable Two-Factor Authentication

A password manager allows you to create and store unique passwords for your bank accounts, social media accounts and more without having to remember them yourself. Using complicated, unique passwords for each online account stored in a password manager means your sensitive data is better protected online.

Additionally, adding an authenticator app can serve as an extra layer of security for your online accounts, preventing hackers from cracking them with your password alone.

Securely Dispose of Documents Containing Personal Information

Criminals can easily access your personal information by dumpster diving. To prevent this, shred credit cards, bank statements, utility bills and other documents that are no longer useful. As for important documents containing your personal information, store them in a secure location like a safe.

What Should You Do If You Think You’re a Victim of Identity Theft?

If you think you’re a victim of identity theft, it’s important to report it to the relevant organizations and shut down any false accounts. It’s crucial to act fast to mitigate the damage that could result from the theft, including unauthorized transactions, financial loss and reputation damage.

Step 1: Contact Your Insurance Provider

An insurance provider can streamline the recovery process after an identity theft. If you have an identity protection plan, contact your insurance provider to see what options are available and how they can assist you with the recovery steps.

Step 2: Freeze Your Credit

Freezing your credit is the best way to stop fraudsters from accessing your credit report or opening fraudulent accounts in your name. You’ll need to freeze your credit with each of the major credit bureaus: Equifax, Experian and TransUnion.

Each bureau will require proof of your identity. You’ll then receive a pin from each of them that you can use to freeze your credit files. You will need that pin to unfreeze your credit, too.

Step 3: Submit an Identity Theft Report to the FTC

The FTC is dedicated to streamlining the recovery process for identity theft victims. To reach the FTC, contact them at IdentityTheft.gov or call 1-877-438-4338. The FTC will provide you with step-by-step advice and helpful resources to secure your identity and prevent further scams.

Step 4: Contact Your Local Law Enforcement Agency

Filing a police report with your local police department can be helpful in cases where you know the fraudster or have information that can help locate them. Even if your identity was stolen by someone online or overseas, filing a police report can create a paper trail that could be useful in prosecuting a future identity theft incident.

Final Thoughts

Identity theft is at an all-time high and will continue to rise as individuals and businesses rely more on the internet for day-to-day operations. At the same time, the adoption and advancement of fraud prevention and detection tools have risen to unprecedented levels and will keep growing as businesses and individuals seek new ways to protect their identities.

To prevent identity theft, it’s crucial to keep abreast of the latest trends in this field. What steps are you taking to protect yourself or your business from identity theft? Have you been a victim of identity theft before? What steps did you take for recovery? Let us know in the comment section below, and as always, thanks for reading.

FAQ: Identity Theft Stats

According to the National Council on Identity Theft Protection, about 33% of Americans have been victims of identity theft in their lifetime.[12]

In 2022, the FTC received more than 1.1 million reports about identity theft. The number of yearly cases is expected to keep growing due to the new methods that scammers are inventing to steal identities.[3]

According to the FTC, people aged 30 to 39 years reported the most cases of identity theft.[9] Millennials have a higher tendency to fall victim to identity theft scams.

Sources:

- Internet Crime Report – U.S. Federal Bureau of Investigation

- Victims of Identity Theft, 2021 – U.S. Department of Justice

- World Report Identity Theft Survey 2023 – U.S. News

- Total Identity Fraud Losses Soar to $56 Billion in 2020 – BusinessWire

- Identity Theft in America: How Many People Are Affected? – All About Cookies

- Biometric Technology Market Size, Share & Trends Analysis Report – Grand View Research

- Fraud Detection and Prevention Market Size & Share Analysis – Growth Trends & Forecasts – Mordor Intelligence

- AI in Fraud Management Market Snapshot – Future Market Insights

- Consumer Sentinel Network Data Book 2023 – U.S. Federal Trade Commission

- ITRC Q3 Data Breach Analysis – Identity Theft Resource Center

- Identity Fraud Statistics: How Businesses Respond to the Issue – Regula Forensics

- 2024 Identity Theft Facts and Statistics – National Council of Identity Theft Protection

- Digital Fraud Wiki – Datavisor