EverSafe Review

Though its more about monitoring service than protection, EverSafe may be the perfect fit for the specific groups it's aimed at: seniors and families. Check out our full EverSafe review to find out more about this interesting identity theft protection service.

EverSafe isn’t your conventional identity theft protection service. Although it goes toe-to-toe in features with our best identity theft protection services, it focuses on seniors and families, rather than the market at large. Although that focus brings forth some unique features, it also comes with some gaps in protection.

In this EverSafe review, we’re going to detail our experience with the service after taking its “plus” plan out for a test run. Along the way, we’ll talk about features, pricing, ease of use, protection and support, all before giving our verdict.

For the most part, EverSafe suffices, even if it doesn’t stand out. The family and senior features are nice to see, and for those who need them, EverSafe is worth it. However, those features aren’t worth the price of admission alone, and seeing how EverSafe is lacking in other areas, it’s hard to fully recommend it.

Features

As we’ll get into in the “protection” section below, EverSafe isn’t so much an identity theft protection service as it is an identity monitoring service. There’s a fine line between the two, and EverSafe offers some identity theft protection on its more expensive plans. However, the core of the service is simply monitoring.

When signing up for an account, you’ll enter your bank account and credit card information, as well as your social security number. EverSafe will notify you of any significant activity on your credit report, too. More importantly, though, it’ll analyze your spending. From this, it can identify any suspicious activity and notify you right away.

EverSafe calls this an “extra set of eyes,” allowing you to identify scams or fraud at the source. If there’s, say, an unusual withdrawal or a late bill payment, it’ll let you know through email, phone or text. Additionally, EverSafe will send you a weekly report detailing any notifications you may have received during the week.

EverSafe Insurance

The cheapest plan, which we’ll talk about in the next section, stops at monitoring. However, if you jump up to one of the more expensive tiers, you’ll also receive $1,000,000 in identity theft insurance. EverSafe will cover any expenses lost while trying to recover your identity, as well as help resolve any issues.

The identity theft protection package — offered on the “plus” and “gold” tiers — offers more than insurance. EverSafe will also monitor the dark web for any personal information you submit, as well as the USPS National Change of Address database. You also have access to a credit report, either from one bureau on the “plus” plan or three bureaus on “gold.”

EverSafe for Seniors and Families

All of this is standard fare for an identity theft protection service. EverSafe has a unique spin, though. It’s tailor-made for families and seniors, allowing anyone to stay protected. Starting with families, you can add as many users as you want to your account, and each additional user will receive a 30 percent discount on your monthly rate.

For example, if you purchase the $14.99 “plus” plan for your family of four, you’ll play $46.47 per month, rather than $60. All family accounts are located in a single dashboard, too, so no matter how many accounts you’re monitoring, you can easily find them.

EverSafe is even better equipped for seniors, though. In addition to being very user friendly — we’ll get into that in the “ease of use” section below — EverSafe allows you to designate advocates for your account.

For example, if a senior wants identity theft protection but can’t use a computer, an advocate can access the dashboard, manage accounts and receive notifications for the user.

Despite all the senior- and family-friendly features, EverSafe is lacking in other areas. It can monitor your bank accounts and credit cards, but that’s about it. It doesn’t monitor any other information, such as your insurance policies, passports or medical information.

EverSafe Features Overview

| Features | |

|---|---|

| Credit Monitoring | |

| Social Security Monitoring | |

| Dark Web Monitoring | |

| Coverage | 1,000,000 |

| Antivirus | |

| Credit Bureaus | Experian, TransUnion, Equifax |

| Knowledgebase | |

| Live Chat | |

| Phone | |

| 24/7 Support |

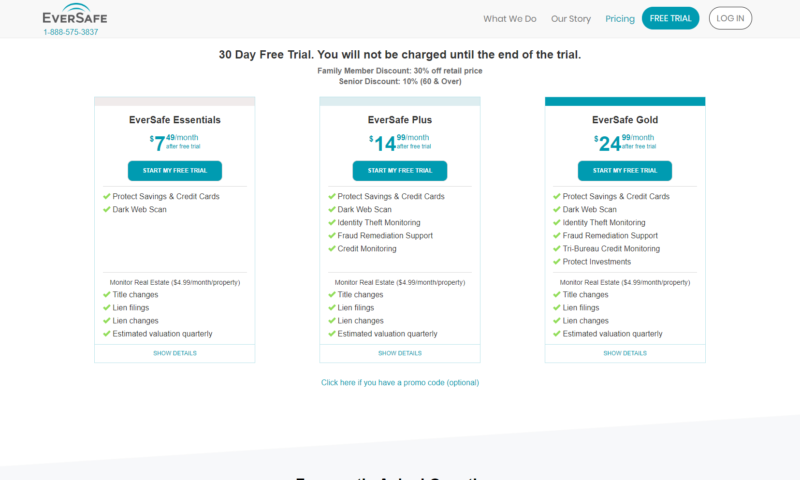

Pricing

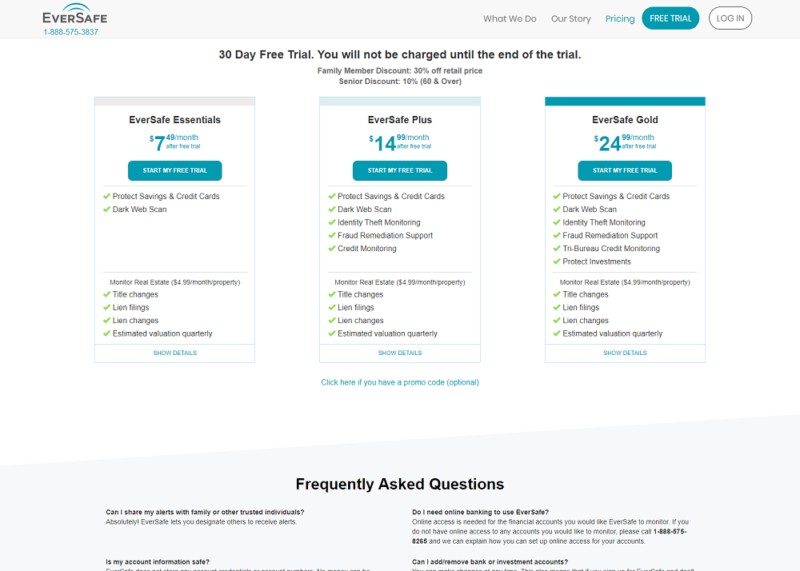

EverSafe has excellent pricing, especially compared to the vastly overpriced LifeLock (read our LifeLock review). However, EverSafe succumbs to LifeLock’s same pitfalls with how it lines out its plans. You can save a few bucks by going with the lowest-tier “essentials” plan, but then you’re not actually buying identity theft protection.

- Credit and Debit Card Monitoring; Bank Account Monitoring; Dark Web Scan; Caregiver Support; Bill Payment Notifications; Account Balances Across Institutions; Monthly Financial Health Newsletter; Monthly Scam Watch Newsletter; 24 x 7 Customer Support

- Everything in Essentials plus; Elder Fraud Monitoring; Identity Theft Monitoring; Fraud Remediation Support; Bureau Credit Monitoring Single Bureau Credit Report; Look-back Analysis; Up to $1 Million Coverage

- Everything in Plus and; Three Bureau Credit Monitoring; Three Bureau Credit Report; Three Bureau Credit Scores; Investment Account Smart Alerts; Retirement Saving Smart Alerts; Real Estate Monitoring

The core service of “essentials” is an AI-learning system that monitors your bank accounts and credit cards for potential fraud. Although this learning system helps prevent identity theft, it doesn’t protect against it. The “plus” and “gold” plans come with true protection, including $1,000,000 in coverage and identity-restoration services.

Identity Guard has a similar three-plan structure, with a budget plan around $7.50 per month. However, as you can read in our Identity Guard review, it still offers $1,000,000 in coverage on its base plan. The higher tiers include additional monitoring features, but the coverage is the same no matter what you’re paying.

EverSafe does the opposite, making its lineup more akin to LifeLock. Although “essentials” is available for those who are looking to save a few bucks, it doesn’t come with any protection, forcing users to upgrade to a higher tier for any coverage. We’d prefer a system similar to Identity Guard, where you’re getting the same protection across the board.

That said, the price isn’t bad. EverSafe “plus” is a few dollars cheaper than a similar plan with IdentityForce and the same price as ID Watchdog (read our IdentityForce review and ID Watchdog review). We’re content with the rate of “plus” and “gold.” The issue lies with “essentials,” which should either include coverage or not exist at all.

You can save some money on the higher-tier plans by purchasing a longer duration. EverSafe lists its rates for a monthly subscription, but it also offers annual billing, each of which come with a discount. For “plus,” the annual subscription runs $12.74 per month.

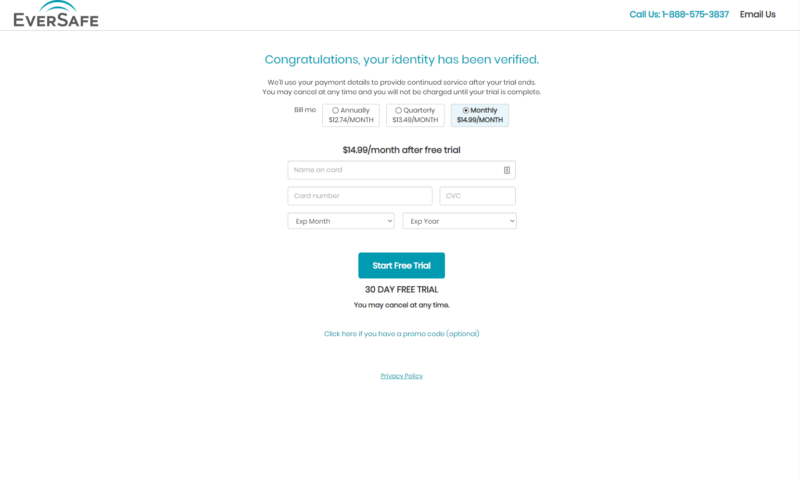

EverSafe Free Trial

EverSafe is one of the few identity theft protection services to offer a free trial. You have 30 days to try out the service, no matter which tier you choose. As with most free trials, you’ll have to enter your credit card information when you check out, but you’ll only be charged once the 30-day risk-free trial is up.

There are other pricing incentives going on, too. As a service focused on families and seniors, there are discounts available for each. Seniors get 10 percent off any subscription, and family members of the initial user get 30 percent off. You can also protect real estate for an additional $4.99 per month per property.

Ease of Use

Getting started with EverSafe is simple, which is good, considering it focuses on seniors and families. On the home page, all you need to click is “start your free trial.”

You’ll be directed to a page that asks some basic questions about what you want to protect, making it easy to find the plan you need. If you want to browse your options, you can also always select the “pricing” tab in the top menu.

After going through the process, you’ll need to enter some personal information, including your social security number, address and phone number. You’ll also have to set your account password, which we recommend generating with one of our best password managers. If you want a specific suggestion, 1Password is always a safe bet (read our 1Password review).

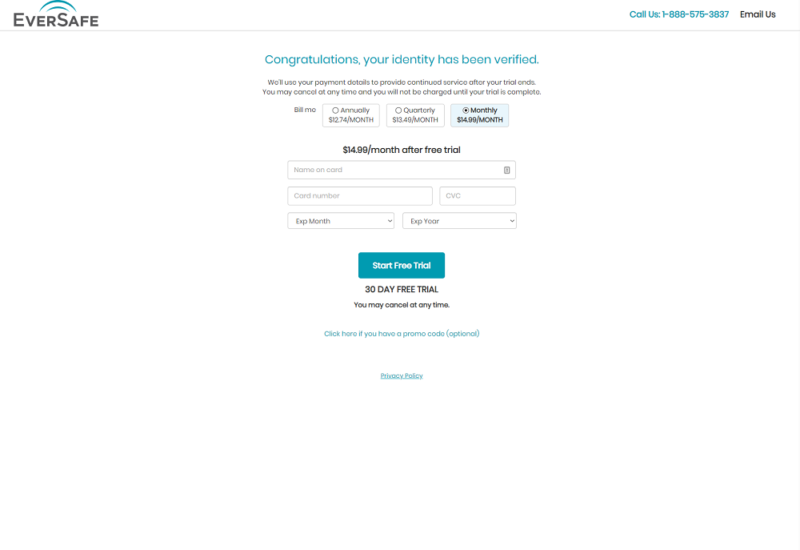

Finally, you’ll have to verify your identity with a short list of questions, similar to applying for a credit card. After all of that, you can enter your payment information. Top-loading the process this way makes it feel painless to sign up for an account because you’ve entered the majority of your information before committing to a subscription.

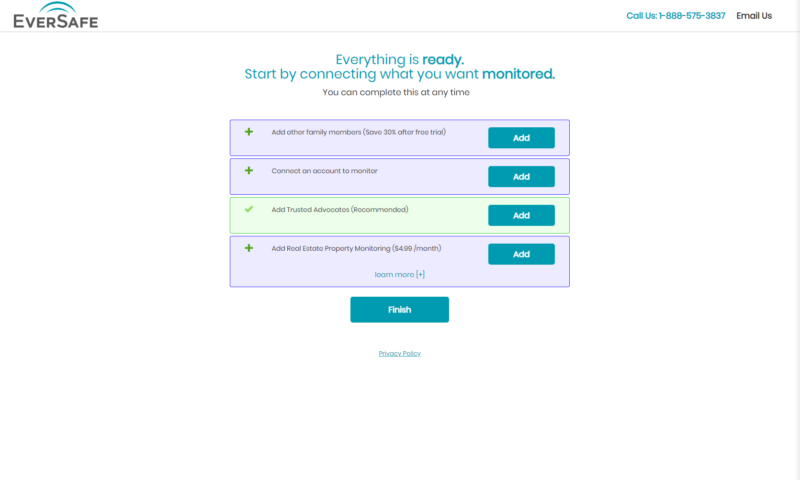

EverSafe Setup

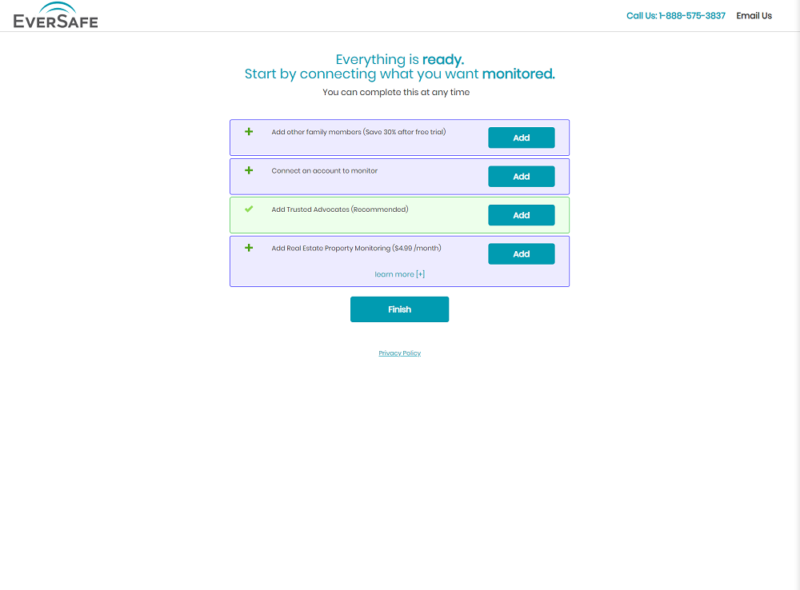

Although EverSafe collects a lot of information during signup, you’ll need to enter more data after confirming payment for it to fully protect you. Once you’ve entered your payment information, you’ll be brought to a page where you can purchase real estate monitoring, as well as add family members, a trust advocate and accounts to monitor.

The most important step is adding a bank account, which EverSafe makes simple. Instead of requiring your account and routing information, EverSafe asks you to sign in to your online banking application.

There wasn’t a bank we couldn’t find, either. The big names are present, including Bank of America and PNC, but we also found regional U.S. banks, such as Great Southern.

After hitting “finish,” you’ll be booted to the account dashboard. It was nice to see EverSafe in instant action, pulling some notifications from our credit report right away. Unlike , you can immediately see what EverSafe is monitoring.

EverSafe Dashboard

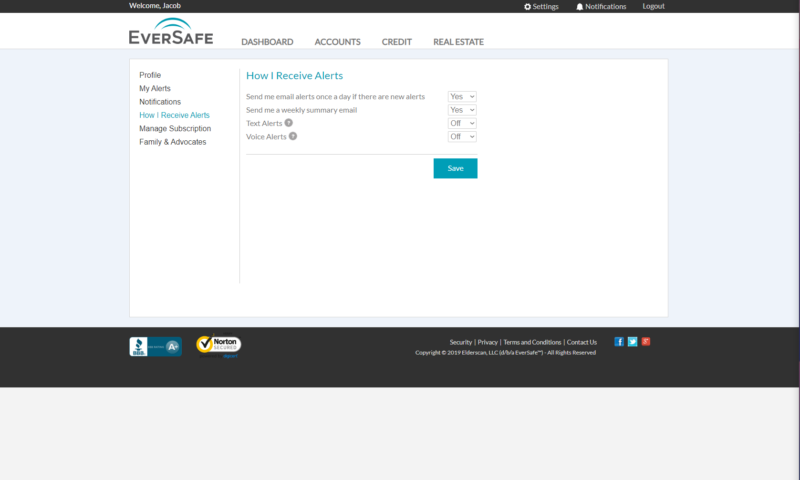

The EverSafe dashboard is focused on simplicity, but even with that, it doesn’t skimp on any critical options. You can navigate it using the four tabs in the top menu, the first of which provides an overview of your account. On the main screen, you can see the accounts you have linked, your credit report and any notifications.

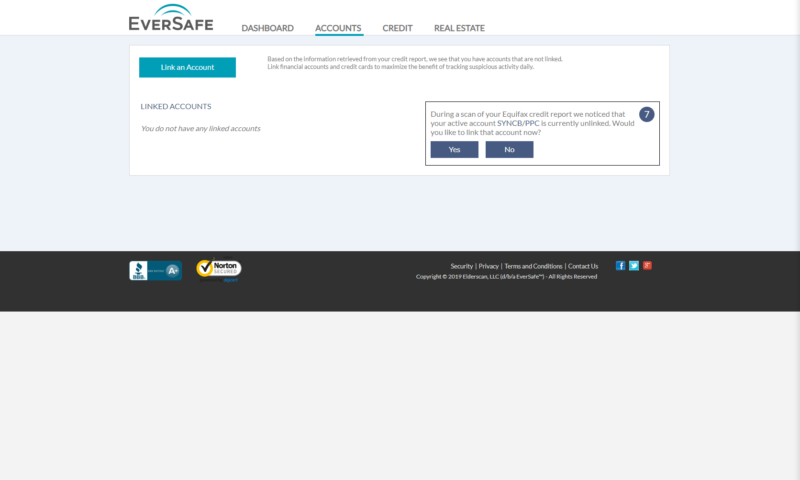

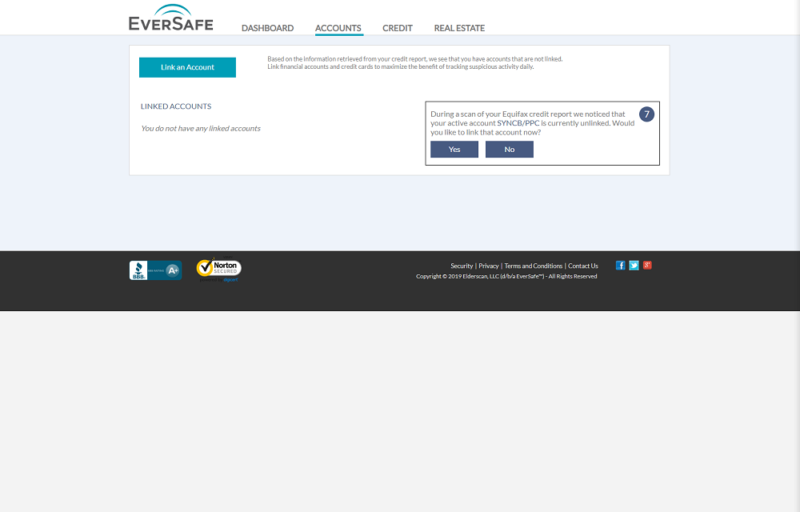

A tab over, you’ll find your accounts. You can link new ones using the process described above, but EverSafe will also use your credit report to look for accounts. If it finds any new accounts — say, a credit card you just signed up for — it’ll show a small pop-up where you can easily link that new account.

To the right of that, you’ll find your credit report, if you purchased a “plus” or “gold” membership. “Plus” comes with a single report from Equifax, showing all of your open accounts, as well as a timeline of payments and inquiries. If you purchased a “gold” plan with a tri-bureau report, you’ll also see information from TransUnion and Experian.

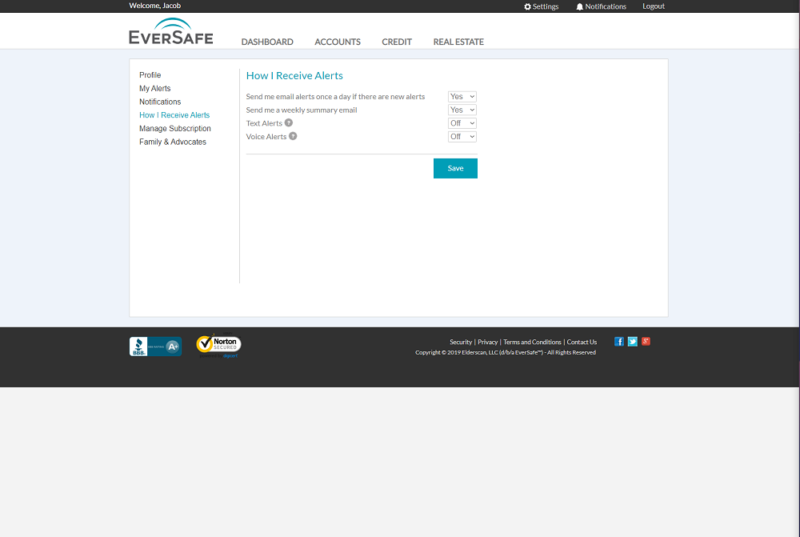

Everything else is located in the settings menu, which you can access by clicking the “setting” button in the top bar. You can add family members and advocates, as well as manage your subscription in the settings. The most important tab is “how I receive alerts,” though. There, you can set up text and voice alerts, as well as a weekly summary.

Protection

As we mentioned in the features section above, EverSafe is excellent for monitoring your bank accounts, credit report and credit cards. However, it falls flat in other areas. Lacking support for passports, medical ID cards, insurance information and more, EverSafe doesn’t offer total protection.

However, for the areas EverSafe focuses on, it surpasses expectations. During our testing, EverSafe alerted us right away of changes, going as far as to pull recent credit inquiries when we first signed up. In addition to keeping an eye on your credit report, EverSafe also scans the dark web and looks at your bank accounts for suspicious activity.

If any issues creep up, you can work with EverSafe to resolve them with the aid of $1,000,000 in lost-expense coverage on the “plus” and “gold” plans. As we’ll get into in the next section, though, EverSafe doesn’t provide around-the-clock support, so if your identity is stolen, you’ll have to wait until EverSafe opens during normal business hours.

However, the real issue lies in that EverSafe can’t protect other aspects of your identity. Credit and bank account monitoring are only two parts of a multi-faceted process, and when it comes to other avenues, EverSafe falls flat. For instance, there isn’t social media protection or any sort of social monitoring.

Furthermore, there isn’t any risk monitoring. Other services, such as ID Watchdog and Identity Guard, offer a risk score, which shows how much you’re at risk of having your identity stolen. EverSafe doesn’t offer any similar feature.

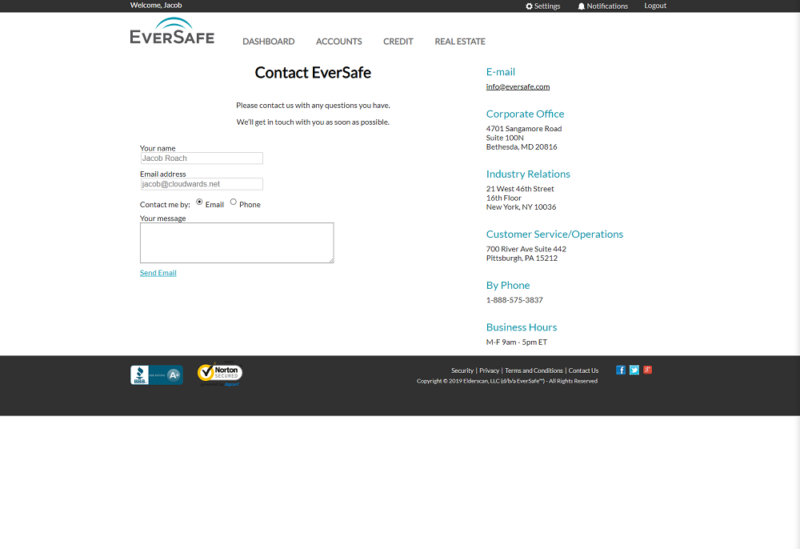

Support

Finding support with EverSafe isn’t easy. From your account dashboard, you’ll have to go search in the footer for the “contact us” button. Clicking on it will bring you to a small contact form and a directory for EverSafe’s different departments. Strangely, this form page is inside the normal dashboard, rather than the support screen.

You’ll still see the top menu of the dashboard, but there isn’t an option there for contacting support. Seeing as EverSafe has the contact page built for the dashboard, it would make sense to have an option for it in the top menu. Instead, it’s reserved for the footer, making the link easy to miss.

As for contact options, EverSafe allows you to reach out via phone or email during its business hours of 9 a.m. to 5 p.m. EST, Monday through Friday. On the main website, the support phone number accompanies the logo, making it easy to get in touch. However, once you make it to the dashboard, it drops the phone number.

EverSafe makes it easier for prospective customers to find support on the main website than it does for returning customers to find it in the dashboard. Once you know where you’re going, though, it’s not hard to find your way back. However, given how simple EverSafe is to use otherwise, a clearer indication of the contact form would be nice.

As far as the dashboard goes, there aren’t any additional support resources. On the main website, however, there are. Through the footer, you can find a resource list that answers some frequently asked questions, as well as a blog that weighs in on current identity threats. Those resources are welcome, but they’re better suited for the dashboard than the main website.

Rather than reserving its support resources for the main website’s footer, EverSafe should reorganize what it has into an easily digestible knowledgebase accessible from the dashboard. In its current state, support resources feel scattered and inconsistent, at best.

The Verdict

EverSafe offers a unique bend on the identity theft protection formula, but in its attempt to cater to a niche market, it skipped on essential areas of protection. Although it’s quick to notify you of credit changes and strange activity in your bank accounts, it can’t monitor your passport, insurance information or social media.

Although coverage for your bank account and credit report may be enough for seniors, it isn’t enough for most people, especially since the majority of identity theft threats are online. If you’re tight on budget, free identity theft protection services are also available. For more holistic protection options, we recommend reading our other identity theft protection reviews.

What do you think of EverSafe? Will you take the free trial out for a spin? Let us know about your experience in the comments below and, as always, thanks for reading.

EverSafe FAQ

EverSafe is an identity theft protection service focused on families and seniors. It offers three tiers of protection, two of which come with $1,000,000 in identity theft insurance and dark web monitoring.