Best Identity Theft Protection: Best-Rated Services in 2025

There are a lot of options for identity theft protection, some of them excellent and others downright concerning. In this article, we’ll cover the best identity theft protection and explain how to keep your identity and credit safe.

We live in an age of encroaching scams and cybercrime, as illustrated by the latest identity theft statistics. The best identity theft protection services incorporate advanced features to tackle evolving threats. Features like dark web monitoring prevent the misuse of stolen identities before it happens, rather than just addressing the aftermath. Other apps focus not just on identity theft but on the financial exploitation that results.

In this article, we’ll pick five of the best services that combine identity theft protection features into a single app. ID theft protection means different things to different companies, so we recommend reading the whole list to see which app addresses your particular needs most closely. If budget is an issue, we’ve also got a list of the best free identity theft protection.

-

11/06/2024 Facts checked

We rewrote this article, exploring new identity theft options and adding the most recent information on identity theft protection.

How to Choose the Best Protection for Identity Theft

While it’s possible to monitor credit reports, account activity and personal information on your own, it can be a time-consuming hassle. Identity theft protection services offer continuous, automated oversight.

Identity theft protection providers should go beyond just monitoring to include proactive measures like alerting you to suspicious activity, scanning the dark web, and assisting you with the recovery of compromised data. Look for the following features as you shop around, then visit our article on how to prevent identity theft for more tips.

- Comprehensive monitoring: A service should offer wide-ranging coverage, monitoring the dark web for potential threats and personal information, like bank account numbers, social security numbers and more.

- Insurance and Recovery Assistance: Should you become the victim of identity fraud, your provider should offer identity theft insurance coverage, to help during the process of canceling and replacing cards, and credit restoration assistance, for help disputing false charges and restoring your credit score.

- Credit Score Monitoring: Regular tracking of your credit score helps detect irregularities, which can be an early sign of identity fraud or data breaches.

- Real-Time Alerts: Receiving immediate notifications of suspicious activity allows you to act quickly to minimize the damage caused by identity theft.

- Ease of Use and Support: A user-friendly interface and 24/7 customer support are essential so you can navigate the system easily and get help as needed.

The 5 Best Identity Theft Protection Services

We looked at dozens of services to find the best options, using the criteria outlined above. Identity theft protection is about your financial peace of mind, so we focused on reliability, reputation and value. Each of these providers has areas where they stand out, and all have a strongly positive review average.

1. Norton LifeLock — Best Overall Identity Theft Protection

Norton’s years of cybersecurity experience.

LifeLock offers a range of features, although many are reserved for the higher-tier plans. The integration of Norton 360 with LifeLock adds antivirus software and a password manager. While the combination enhances overall protection, users may find the dashboard in the combined services to be cluttered with advertisements promoting upgrades.

Norton LifeLock Hands-On Testing

Norton LifeLock provides a smooth UI, but there are a few quirks. Setup is quick, and we appreciate the customizable alerts for suspicious activity. However, the interface occasionally lags, particularly when synching new data like credit reports. The mobile app is a bit more streamlined, but the desktop could benefit from further optimization.

Is Norton LifeLock Legit?

Norton LifeLock is a legitimate identity theft protection service with a more comprehensive approach than many competitors. It offers up to $3,000,000 in stolen funds reimbursement in its highest level plans, and offers hands-on recovery assistance for complex issues like tax or medical identity theft. Its depth of coverage and support make it a good choice.

Norton LifeLock Pricing Plans & Value

Norton LifeLock comes with three identity theft protection plans. The Standard plan includes essential services like identity alerts, $25,000 in stolen-funds reimbursement and $25,000 in personal expense coverage. All this comes for $7.50 per month billed on the first year of the annual plan.

The Advantage and Ultimate Plus plans are $14.99 and $19.99 respectively. Both include buy-now pay-later alerts. The Plus plan includes higher personal expense and stolen funds reimbursement at $100,000, and the Ultimate plan includes $1 million. For more on this provider, check out our full Norton LifeLock review.

2. ID Watchdog — Best Identity Theft Protection for Health Care Providers

ID Watchdog offers a variety of useful features like dark web monitoring, customizable alerts and $1,000,000 in insurance. Its Premium plan includes a National Provider ID Alert feature for healthcare providers, which monitors the NPI database for changes associated with your ID and alerts you if your account is modified in a way that could indicate identity theft.

Healthcare provider identity theft is when scammers use a medical provider’s credentials to bill insurance for false treatments or prescriptions, which can lead to massive financial loss and compromised patient care.

All plans include sex offender reporting, which lets you know if offenders move in or out of your neighborhood and provides locations, photos and information. Plans also include public records monitoring that scours records for names or addresses associated with your identity, plus credit freeze assistance and in-house customer care.

The Premium plan adds three-bureau credit reports. All plans also come with subprime loan monitoring, which sends you an alert if activity is detected in your name outside the traditional banking system. It also scans for your information on over 150 sites that aggregate and sell personal data taken from social media, retailers and public records.

ID Watchdog Hands-On Testing

ID Watchdog has a dashboard that lets you quickly see alerts and access identity theft protection tools. The interface can feel a bit dated compared to competitors, but it works well and is easy to use.

Customer support is available 24/7 by 1-800 number or email. Customer service is handled in-house and is responsive and knowledgeable. Help is available in over 100 languages including English and Spanish.

Is ID Watchdog Legit?

ID Watchdog is a legit, reputable company with an A+ rating on the BBB website and positive reviews across the web. It is a subsidiary of Equifax, one of the three major credit bureaus in the U.S. Its comprehensive monitoring in areas like subprime loans and medical fraud make it a good choice for users seeking thorough protection.

ID Watchdog Pricing Plans & Value

The Select plan starts at $14.95 per month for one user billed monthly, or $150 per year. If you wish to cancel at any time, you will be refunded for any fully unused months. The premium plan is $21.95 monthly or $220 per year. The family plan is $23.95 monthly for standard and $34.95 monthly for Premium, and includes a second adult and four children (under 26 years old).

3. Identity Guard — Best Identity Theft Protection for Proactive Threat Monitoring

Identity Guard monitors a wide range of potential threats using IBM’s Watson AI, including attacks on bank accounts, information leaks like social security numbers and personal information being sold on the dark web. It offers regular updates and real-time alerts to help users spot any unusual activity that could indicate a data breach.

Identity Guard offers $1,000,000 in insurance coverage for identity theft victims. The Ultra plan adds recovery assistance (called “white glove fraud resolution”) and case management with personalized support, should fraud occur. The cheaper plans do not have that service, but they do include a user-friendly interface and 24/7 customer support for the app itself.

Identity Guard Hands-On Testing

Identity Guard’s interface is generally intuitive. The dashboard displays key information upfront, such as alerts and monitoring status. However, the sheer amount of features available can make navigation a bit overwhelming, especially for users new to identity protection services.

Is Identity Guard Legit?

Identity Guard is a legit identity theft protection service. It has been in operation since 1996 and is now owned by Aura, a newer but very well-known cybersecurity company. It has both positive and negative user reviews, but overall the service is well-regarded and trusted.

Identity Guard’s Value plan starts at $7.50 per month billed annually and includes dark web monitoring, data breach alerts and $1,000,000 in identity theft insurance. The Total plan is $16.67 per month and offers everything the Value plan does, plus bank account monitoring. The Ultra plan includes a lot of extra features like address and home title monitoring.

For more on this provider, check out our full Identity Guard review.

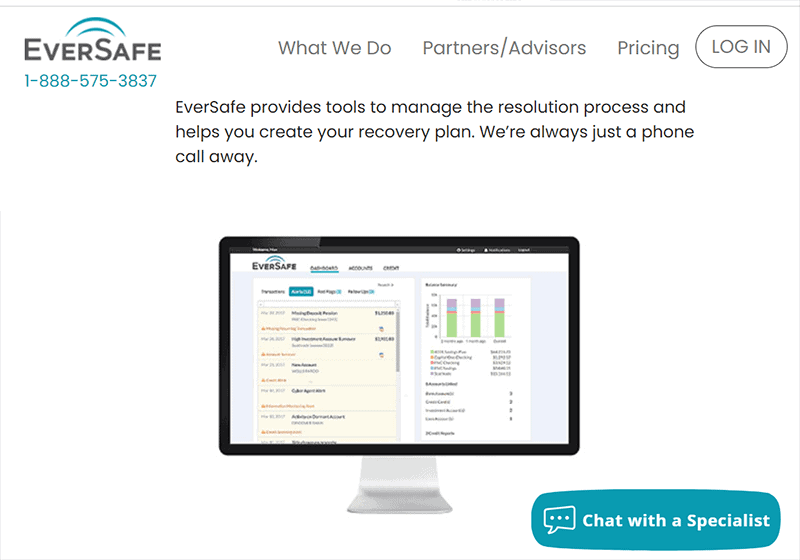

4. EverSafe — Best Identity Theft Protection for Seniors

EverSafe is designed with a focus on seniors and families, which makes it different from other services out there. Rather than offering features for any conceivable situation, it focuses on monitoring financial activity and alerting you to suspicious behavior. It allows users to track bank accounts, credit cards and social security numbers to detect identity theft as early as possible.

All plans include Caregiver Support which allows a designated individual to monitor your account alerts. Basic coverage with the Essentials plan gets you credit and debit monitoring and dark web scanning, but no credit monitoring.

EverSafe stands out for its user friendliness and specific features for seniors, but the Essentials plan may not be enough for users looking for full protection. For more on this service, check out our EverSafe review.

EverSafe Hands-On Testing

EverSafe is easy to set up and navigate, with straightforward dashboards that make monitoring multiple accounts easy, especially for caregivers. Its automated alerts can be fine-tuned to focus on specific activities. The platform also integrates well with banks and credit unions, but data synching between banks and the app can occasionally lag, leading to slight delays in updates.

Is EverSafe Legit?

Yes, EverSafe is legit. It is a well-regarded financial monitoring service that focuses on protecting seniors from fraud, identity theft and financial abuse. It has positive online reviews and no history of fraud or misrepresentation.

EverSafe Pricing Plans & Value

The Essentials plan costs $6.36 per month billed annually, but is fairly light on features and doesn’t include any credit monitoring. The Plus plan, at $12.74 per month (one-year plan), has single bureau Experian credit monitoring, and the Gold plan at $21.24 per month (one-year plan) has three bureau credit monitoring. Both the Gold and Plus plans include $1,000,000 in identity theft insurance.

There is a 20% discount for all seniors over 60 available on all plans. For more on this provider check out our full EverSafe review.

5. Aura — Best User Friendly Identity Theft Protection

protection software that offers family plans.

Aura’s monitoring covers bank accounts, social security numbers and the dark web. Aura also includes up to $1 million in identity theft insurance and recovery assistance. The service includes credit score monitoring to help spot irregularities that may signal fraud, along with real-time alerts for suspicious activity.

It monitors criminal records to identify if your information is used during a criminal incident, payday loan applications that let you know if someone tries to secure a high-interest loan in your name, and address changes that notify you if your mailing address has been fraudulently altered. You can also freeze or lock your credit directly through the app.

Aura Hands-On Testing

When you log into Aura, the dashboard provides an overview of key information such as alerts, credit scores and device status, making it straightforward to check for potential threats or updates. The service sends real-time alerts through mobile push notifications, emails or SMS, and we found all these formats easy to receive and act on.

The depth of certain features like device protection tools including antivirus software and a VPN can take some time to fully understand if you’ve never used one before. Setting up and customizing dark web monitoring and recovery assistance may take an initial time investment to familiarize yourself with how it works, but overall Aura feels very intuitive to use.

Is Aura Legit?

Aura is a legitimate company that was founded in 2019. It acquired the much older company Identity Guard in 2019 when Intersections Inc and iSubscribed merged to form Aura. Despite its short history and some negative reviews, Aura has gained credibility through well-received service offerings which bundle identity theft protection with antivirus software and VPNs.

Although Aura and Identity Guard share the same parent company, they offer distinct services. Identity Guard was founded in 1996 and was one of the first companies in the identity theft industry. Identity Guard was purchased by Aura, but the two companies maintain their autonomy.

Aura Pricing Plans & Value

All Aura yearly plans come with a 14-day free money-back guarantee and include three-bureau credit monitoring. The cheapest plan is Individual for $12 per month billed annually, which includes one user across 10 devices. There’s a Couple plan that covers two adults and 20 devices, and a Family plan that covers five adults and unlimited children and devices.

Our Methodology: How We Tested the Best Identity Protection Software

We interacted with every feature of all the prominent ID protection software on the market, looking for quirks, weaknesses and unique advantages. To bolster our own experience, we evaluated customer reviews and feedback for the best balance of effective protection, reliability and user confidence.

How Does Identity Theft Occur?

Identity theft is when someone illegally obtains your personal information such as your social security number, credit card details or bank account information — generally to use it for financial fraud. Understanding how identities get stolen is key to protecting yourself. Here are some of the most common ways identity theft happens.

- Phishing: Scammers send fake emails or texts that appear to be from legitimate companies. These messages contain links to malicious websites designed to steal your personal information when you visit them.

- Data Breaches: Large-scale data breaches can expose sensitive information stored by companies. Hackers then sell this data on the dark web, allowing criminals to access your accounts. Even if your most sensitive accounts use secure passwords, hackers can still breach them if you’ve reused passwords from less-secure websites.

- Skimming: Identity thieves use small devices called skimmers to steal your credit or debit card information at ATMs or point-of-sale machines. Once they have your number, they can make unauthorized transactions.

- Mail Theft and Dumpster Diving: Thieves can steal sensitive documents from your mailbox — including bank statements, tax returns or medical statements — which can be used to access your personal information. The same documents can also be stolen from your trash.

- Social Engineering: Scammers may manipulate you into providing personal information by pretending to represent trusted authorities, like the police, the IRS or a company you do business with.

- Public WiFi Snooping: Public WiFi networks are often unsecure, making it easy for hackers to intercept the data you send while connected.

Common Types of Identity Theft

Here are the most common types of identity theft.

What Does An Identity Theft Protection Company Do?

An identity theft protection company guards your personal information by monitoring a wide range of data sources for signs of fraudulent activity. These services typically track your social security number, credit reports, bank accounts, credit card transactions and public records, such as criminal records or address changes.

The software will alert you if it detects any suspicious activity, like an unauthorized credit inquiry, a change in your bank account details, or your social security number being used for a new loan application. When an identity theft protection company finds your information being used without your authorization, it notifies you and may help you take corrective action.

Preventing Identity Theft: Why Is It Important To Have Identity Theft Protection?

Once your personal information is compromised, the financial and emotional toll can be significant. Identity theft can lead to drained bank accounts, damaged credit and even legal troubles if the thieves commit crimes in your name.

The time and effort required to resolve identity theft can be overwhelming, often involving contacting multiple banks, credit bureaus and government agencies to correct the damage. Without protection, these incidents can go unnoticed for months or years, allowing thieves to continue exploiting your identity and making the resolution process more challenging.

Is Identity Theft Protection Worth It?

There is a lot you can do on your own for free, such as freeze your credit at each of the three main credit bureaus. Victims of identity theft can find a wealth of information at the U.S. government’s identity theft resource website.

However, it’s easier to have the help of professionals. If you don’t want to go it alone, identity theft protection is well worth it. If you want some more hard data to make the call, see our identity theft by state research post.

Final Thoughts

Choosing the right identity theft protection service is essential to safeguard your personal and financial information. Norton LifeLock stands out for its combination of features, user-friendliness and a low overall identity theft protection cost. ID Watchdog is another great choice, and EverSafe is perfect for seniors and caregivers.

What concerns you most about identity theft? Are you using any protection service right now? How important is ease of use versus comprehensive coverage when choosing an identity theft service? Let us know in the comments, Thank you for reading!

FAQ: ID Theft Protection

The best defense is to prevent identity theft with sound habits. Be aware of the various ways your information might get into the wrong hands and put systems like credit freezes and identity theft protection software in place to mitigate the risk.

Depending on your specific needs, there may be better options for ID theft protection software. For example, ID Watchdog has a lot of features families might find useful. EverSafe may be a better option for seniors as it has specific features to help with caretaking.

Most of the companies on this list have identity theft recovery services, but the one with the best reviews for identity theft recovery is Norton’s LifeLock.

Both Aura and Lifelock have mixed reviews but overall solid reputations. Norton has been around for longer, while Aura may be easier to use if you’re not tech-savvy.