KuCoin Review

KuCoin claims to handle one of every four cryptocurrency transactions worldwide, but it can be forbidding for the first-time trader. Our KuCoin review has all the details – including whether you can trade from the U.S. despite KuCoin not being licensed there.

KuCoin is a cryptocurrency exchange launched in 2017. It’s known for its minimal trading fees and for a massive customer base that makes it an extremely flexible market. However, it also has its downsides — most significantly, that it lacks a U.S. operating license. In our KuCoin review, we’ll explore all sides of this mega-popular “people’s exchange.”

Key Takeaways: KuCoin Crypto Exchange

- KuCoin is a poor choice for novice crypto traders. It’s best for traders who live outside the United States and want to invest in lesser-known assets.

- You can use KuCoin from the U.S., but you won’t be able to deposit fiat currency and your trading volume will be limited.

- Other than the massive asset selection, the best thing about KuCoin is the absence of monthly account fees. If you trade at a high enough volume, it’s possible to do business without paying the exchange a dime.

You can use KuCoin from the United States, but on a “swim at your own risk” basis. American accounts don’t go through any know-your-customer (KYC) protocols, so if you get scammed or hacked, you won’t get any support from the exchange. Outside the U.S., the picture is better, though still not 100% rosy — as we’ll explore through the rest of our KuCoin review.

Before you go on, note that trading crypto is incredibly risky, even at the best of times. Crypto is highly volatile and prone to steep crashes that can wipe out your savings. The risk is even greater if you delve into margin trading (which KuCoin permits). Before putting any money into crypto, make sure you have a safety net and an exit plan.

Before you go on, know that crypto trades are incredibly risky even in the best of times. Crypto values can rise, but they can also plummet, leaving you wiped out. This risk is multiplied many times over should you start speculating in crypto derivatives.

KuCoin Review: Pros & Cons

Pros:

- No monthly account fees

- Low trading fees

- Large user base

- Trades obscures currencies

- Wide range of derivatives

Cons:

- No U.S. operating license

- Difficult to use website

- Hard to buy unpopular assets

- Hacked in 2020 & 2023

- Bad reputation with users

Overview & Background

KuCoin’s infrastructure has existed since 2013, but it made its first offering in 2017. It’s slightly unclear where the company is currently based. As near as we can tell, it’s operated by a remote team with an HQ in the Seychelles and works with a Singapore firm to secure its assets.

For at least a year after its launch, KuCoin claimed a Hong Kong address. Then in early 2018, a Hong Kong blogger investigated its offices and found nothing there. The blogger feared that KuCoin was really incorporated in mainland China — a serious concern, since the Chinese government was already talking about freezing all crypto trades (which it did in 2021).

Today, KuCoin claims the Seychelles location but embraces its decentralized identity and bills itself as the most globalized exchange. Despite the crypto winter of 2022, it has continued to grow massively, with 27 million worldwide users and a total transaction volume of over $3.6 trillion.

2023 Twitter Hack

In April 2023, KuCoin’s Twitter account was hacked by unknown saboteurs, who made a fake announcement that scammed users out of about $22,000 worth of cryptocurrency. KuCoin reclaimed its account after 45 minutes and seems to have promptly reimbursed losses for all affected users.

It should be noted that this was a social engineering attack against a social media account, not a hack of KuCoin itself. KuCoin is as anonymous and untraceable as any other cryptocurrency (that is to say: mostly, but not entirely). If you’re unsure at all, we strongly recommend using a VPN for crypto trading.

Coins Available

KuCoin’s founders were partly motivated by a desire to introduce more cryptocurrencies into the mainstream, and to this day, it’s one of the best markets for obscure coins. The KuCoin exchange offers more than 750 options and well over 1,000 trading pairs, from giants like Bitcoin and Ethereum all the way to OpenDAO (currently trading at $0.00000011 per coin).

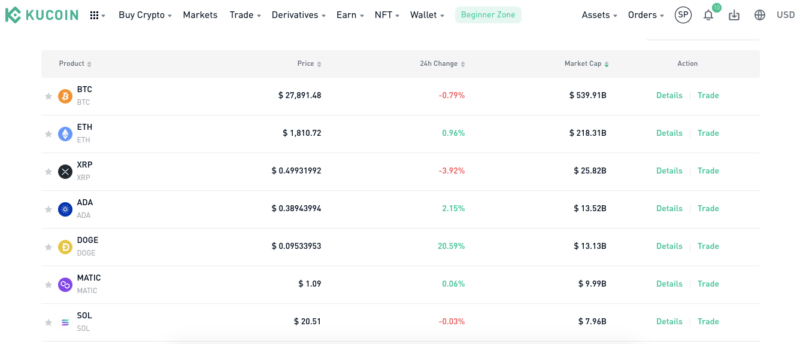

At the time of writing, these were the 10 most popular currencies on KuCoin by market cap:

- Bitcoin (BTC)

- Ethereum (ETH)

- XRP (XRP)

- Cardano (ADA)

- Dogecoin (DOGE)

- Polygon (MATIC)

- Solana (SOL)

- Binance USD (BUSD)

- Litecoin (LTC)

- Polkadot (DOT)

You can get your hands on stablecoins, meme coins, Web3 assets, NFTs and just about every other blockchain currency you can name. Thanks to the broad popularity of KuCoin’s trading platform, you’re more likely to find obscure assets than you might be on other exchanges. Its large user base is a powerful self-perpetuating perk.

Other Products Available

KuCoin offers other crypto derivatives besides the simple “spot trading” of one currency for another. You can trade futures (agreements to purchase an asset at a set price and time in the future) or engage in margin trading (investing with borrowed money at the risk of going into debt if your asset’s price drops).

Users can also participate in KuCoin Earn, which claims to provide more stable earnings — similar to buying mutual funds instead of stocks. You can make money through staking (using your own money to support the operation of a cryptocurrency) or through lending out cryptocurrency in your wallet in exchange for interest. Learn more in our crypto lending guide.

Unless you live in the United States, you’re free to use fiat currency to buy crypto and to withdraw crypto from your wallet as fiat currency. This comes with its own transaction fees (which we cover further under “deposit and withdrawal fees” in the next section).

Trading Fees & Rates

KuCoin aims for low fees. Unlike many of its competitors, including Coinbase (see our Coinbase review), KuCoin doesn’t charge any sort of monthly account fee — all fees are based on transfers.

The cost of a KuCoin transaction depends on three factors: the number of trades you’ve made in the last 30 days, the popularity of the asset being traded and whether your order classifies you as a “maker” or a “taker.”

Levels and Classes

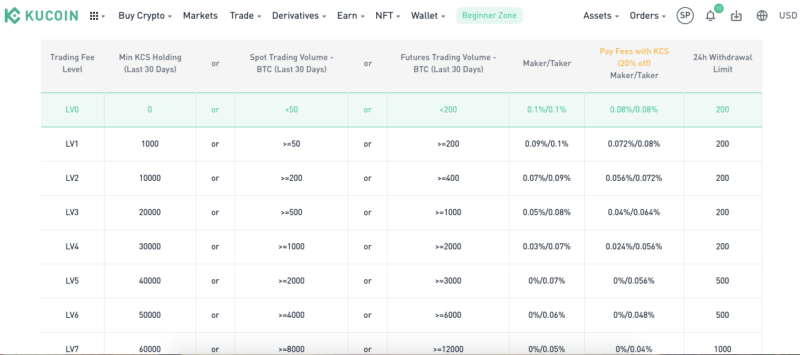

Everyone starts at LV0 and can move up the levels in one of three ways: spot trading, futures trading or holding the KuCoin token, KCS. For example, you can reach LV1 by holding 1.000 KCS, 0.050 BTC or 0.200 in bitcoin futures. By the time you reach LV5, you pay nothing for maker transactions. At LV8, KuCoin starts paying you to trade.

KuCoin also separates its assets into classes A, B and C. Class A contains the most popular trades, B the middling trades and C the most obscure. Class A is the least expensive class, while C is the most expensive — for example, at LV0, all class A transactions (maker and taker) cost 0.1%, class B transactions cost 0.2% and class C transactions cost 0.3%.

The maker/taker dichotomy is the final factor determining the cost of each trade. A “maker” transaction agrees to buy an asset once it reaches a certain price; until that price is reached, it adds liquidity to the market. Buying immediately at the current price removes liquidity, so you get charged more as a “taker.”

There are a few miscellaneous costs and discounts available. Trading bots are always LV0, and all futures transactions are considered to be class A. You also get a 20% across-the-board discount on all fees paid in KCS, though be warned that it’s as volatile as any other crypto asset.

Deposit and Withdrawal Fees

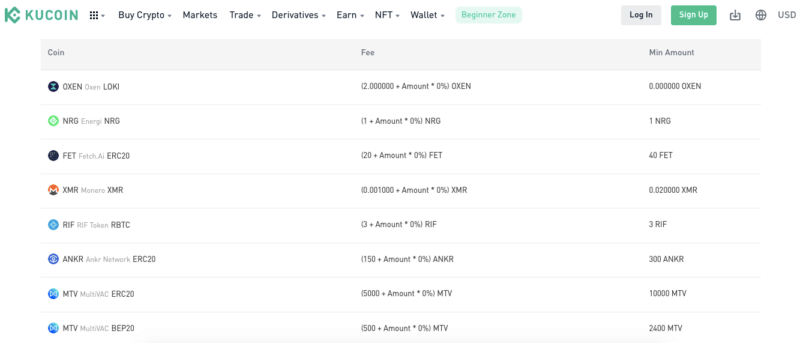

KuCoin maintains a separate fee structure for converting between fiat currency and crypto assets. If you’re buying crypto for your wallet — that is, converting fiat to crypto — there’s no fee. However, for a withdrawal — converting your cryptocurrency back to fiat — you’ll be charged a portion of the cryptocurrency you’re taking out.

Withdrawal fees vary with the market; an updated list can be found on the deposit/withdrawal tab of KuCoin’s fee rate page. For example, if you want to sell Bitcoin and turn it back into fiat currency, as of this writing, you’ll be charged 0.0005 BTC.

User Experience

KuCoin is known for size and liquidity, not for a welcoming learning curve. Despite its “people’s exchange” marketing, KuCoin struggles to offer a user-friendly experience, with features that range from the poorly explained to the flat-out forbidding. We defy any new trader to look at the spot trading page without panicking.

Design is only one problem, however. Even if you know exactly how to use KuCoin’s features, they still frequently fail to work as advertised. In this section, we’ll go into detail about the process of signing up, trading assets, staking and getting help on KuCoin.

Signing Up for a KuCoin Account

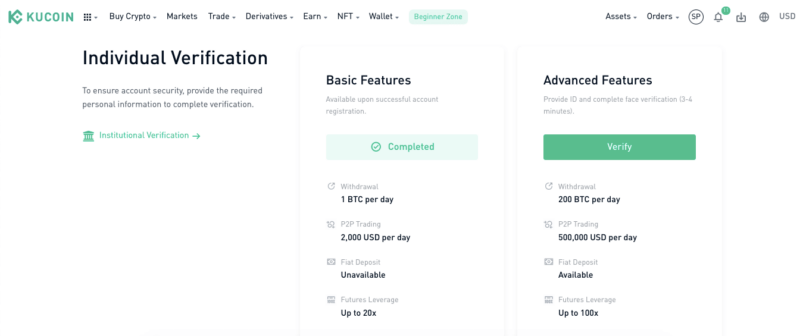

Because we’re based in the United States, signing up for a KuCoin account was incredibly easy — just set credentials, complete a quick CAPTCHA, enter a verification code and start trading. This was because KuCoin can’t use its KYC protocol in the U.S., since that requires a full operating license from the government.

Using KuCoin in the United States isn’t illegal. Anybody can use it without completing the full KYC, but unverified accounts face some restrictions. Without verifying, you can only withdraw up to 1 BTC per day, trade up to $2,000 worth of assets per day and leverage futures a maximum of 20x.

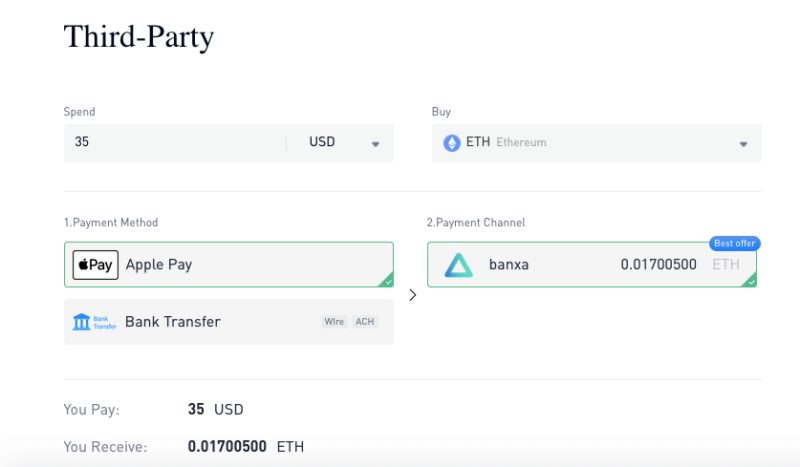

Out of all the restrictions, being unable to deposit money in fiat currency stings the most. Unverified KuCoin users, and all Americans, have no way to hold fiat currencies in KuCoin and wait for the right time to spend it on cryptocurrency — their only choice is to buy crypto immediately or go through a third-party wallet service (see our best crypto wallet guide).

Traders outside the U.S. can complete KYC verification to unlock full trading capabilities. This requires submitting a government-issued ID and waiting for approval. Completing it raises the daily withdrawal limit to 200 BTC, the trading limit to $500,000 and the futures leverage to 100x, as well as enables direct fiat deposit.

Crypto Trading on KuCoin

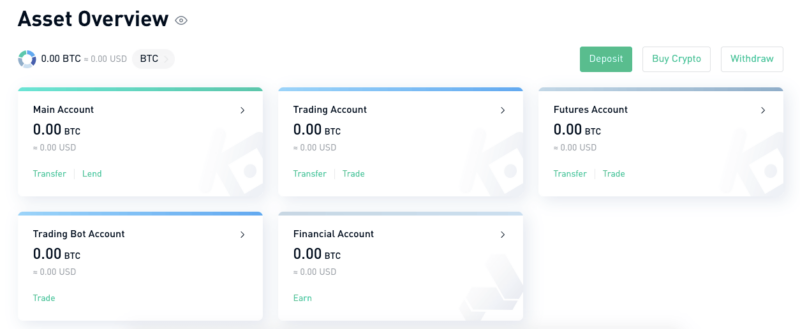

KuCoin starts users with five types of accounts:

- Main account: holds the cryptocurrency you purchase and can loan it out

- Trading account: for making spot trades and holding KCS (the KuCoin token) to pay trading fees

- Futures account: can be used to trade futures

- Trading bot account: for setting up automated trade

- Finance account: for staking

The easiest way for a U.S. user to place assets into any account is to go through the “third-party” option — “fast trade” is useless, as it just limits your currency options before redirecting you to the third-party page anyway. Non-American users can choose from several payment methods, including a credit or debit card, bank account transfers and Alipay.

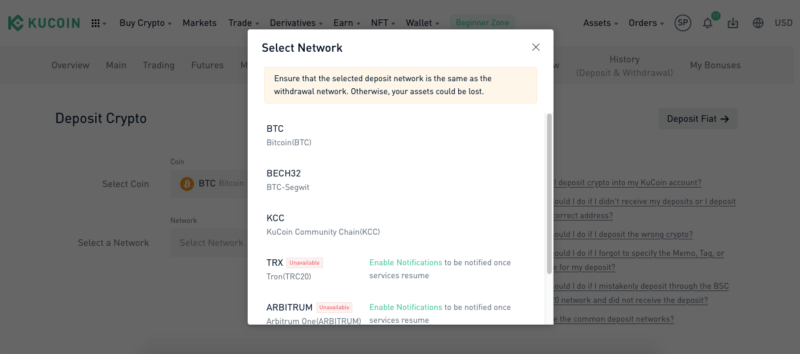

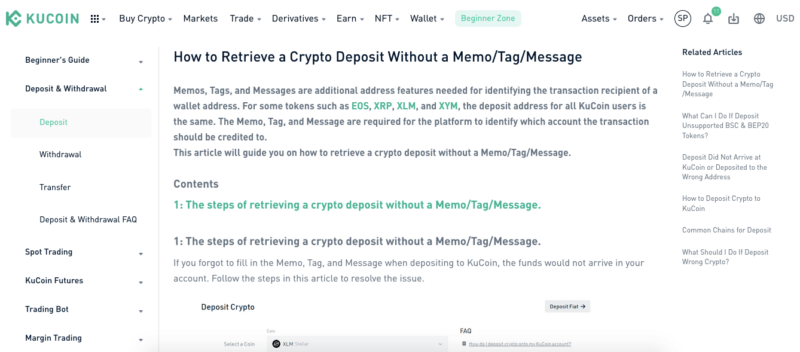

Transferring Crypto

You can also get started by transferring cryptocurrency from another account into your KuCoin account. This is fairly simple: just choose the asset you want to move, select the matching network and copy the withdrawal address. Go to the wallet from which you’re withdrawing assets, and paste in the address to move your money.

It can be a confusing maneuver, but it’s not likely to come up for first-time crypto investors. If you’re just getting started, you’re better off sticking to fast purchases.

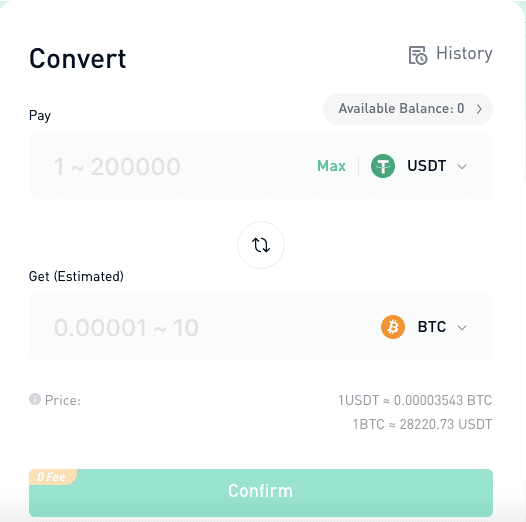

In the same way, new investors who want to trade one asset for another could go through the hassle of spot trading, but that’s better avoided until you know what you’re doing — even the KuCoin website calls it “tedious.” The convert function is a far easier option, though slightly more limited.

KuCoin’s Convert Tool

On the “convert” tab, just pick the asset you want to pay with and the asset you want to buy, then hit confirm. The window helpfully shows you the current exchange rate. The only catch is that you can’t trade all of the more than 750 available assets here — only about 50 can be converted.

The limited selection for conversion illustrates the fundamental paradox of KuCoin: its main selling point is an enormous selection of assets, but quality-of-life features are available only for the assets also sold on every other exchange. If you want to trade Bitcoin, Ethereum or Litecoin, there’s no reason not to go to Binance instead (see our Binance review).

Fortunately, experienced traders who want to speculate in rare, unknown cryptos probably already know how to use advanced features of an exchange. Those advanced traders are the true target audience of KuCoin.

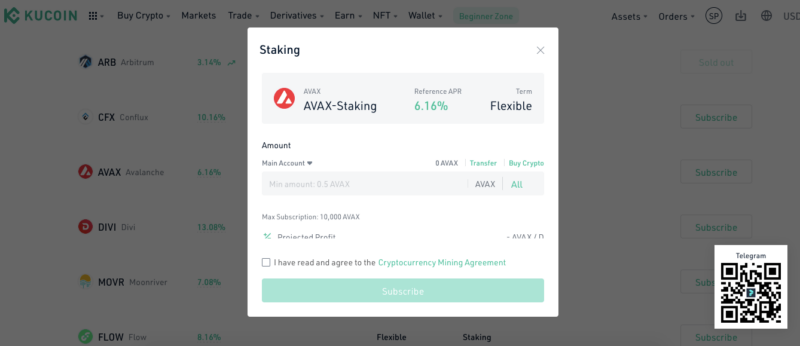

Staking on KuCoin

KuCoin comes with several ways to earn passive income on your cryptocurrency holdings. You can lend your crypto for margin trading and earn interest, much like a traditional bank. KuCoin guarantees that all loans will be repaid, though it’s not entirely clear what funds exist to back up that promise.

Staking is a less risky (though not risk-free) method for earning a profit on your holdings. Blockchain networks take a lot of money to run; to stay upright, they borrow money from users in exchange for some coins to be mined in the future. In other words, you’re staking money now to make a profit from the cryptocurrency’s continued existence.

Staking on KuCoin is simple. Just go to the “earn” tab and you’ll see a full list of all the assets offering any sort of passive income. Staked assets will appear in your financial account. You can also select a “savings” asset, which effectively turns a cryptocurrency into a high-yield savings account.

Customer Support

Support is one of KuCoin’s biggest weaknesses. The help center does a poor job of explaining how to use the website and an even worse job of introducing neophytes to the often-impenetrable jargon of the crypto world. Almost every feature we’ve described here was only unlocked through trial and error.

The help pages are also clearly outdated, frequently referring to links that no longer exist on the website. Luckily, there’s a live chat option, though it’s a bot by default — you’ll have to ask it to talk to a live agent, and it may not understand the first time you try.

Reputation

KuCoin’s image as a popular and widely used exchange doesn’t always match up with its reception from users. A staggering 74% of Trustpilot reviews gave it one star.

Some of the bad reviews referred to a 2020 hack that saw users lose more than $280 million — at the time, the third-largest crypto exchange hack in history. Over several months, investigators managed to recover all the stolen assets, and it now seems as though nobody suffered any permanent losses.

Unfortunately for KuCoin, its bad reviews didn’t end when the hack was resolved. In 2023 alone, many users complained of the KuCoin platform canceling trades, disabling accounts for no apparent reason and blowing off complaints directed to customer service.

Granted, review sites are biased toward the negative, but the KuCoin exchange still comes out quite a bit worse than similar cryptocurrency exchanges like Crypto.com (see our Crypto.com review).

Final Thoughts: KuCoin

Since we’re located in the United States, it was hard for us to get a clear picture of what using KuCoin is like. There’s no question that direct fiat deposit would have made the whole experience feel a lot cleaner.

One thing is clear, however. Until KuCoin gets a U.S. license, it’s simply not worth using in America. Other crypto exchanges have their operating licenses. Why take the security risk of using KuCoin without full verification and with limited functionality to boot?

There’s only one answer to that question: You’ve discovered an obscure asset that could be the next big thing, and no crypto exchanges offer it, except KuCoin. That’s your prerogative, but for all other cases, we recommend Binance or Coinbase instead.

Have you traded crypto assets on KuCoin? Did your experience match up with the bad reviews, or did the people’s exchange do the job for you? Sound off in the comments, and thanks for reading.

FAQ

It may not be as safe as some of its competitors. In 2020, hackers took KuCoin for about $280 million, the third-largest crypto heist ever. To be safe, we recommend you always keep your crypto assets in a separate wallet, never hosted directly on an exchange.

Yes, but you’ll face tighter trading limits and won’t be able to deposit fiat currency. A U.S. KuCoin account also offers no protection, so you’re on your own if you get hacked.

Completing a know-your-customer (KYC) check is not required to use KuCoin, but verified accounts enjoy much higher trading limits, additional features and better security.