Binance Review

Binance is probably the biggest name among cryptocurrency exchanges, but what’s it like to use, and what are its fees like? We go over these questions and more in our Binance review.

Binance is one of the biggest names in the cryptocurrency space, popular among veteran and novice crypto traders alike. In this Binance review, we’ll go over what you need to know about this crypto exchange to see if it’s the right choice for you.

Key Takeaways: Binance

- Binance is among the biggest trading platforms out there, but has also attracted the attention of regulators as a result.

- Binance probably has the biggest offering of products, including advanced trading options like derivatives and loans.

- There are essentially two Binances: one for U.S. customers, and one for everybody else. The U.S. version has higher fees.

- The Binance website is easy to use and offers incentives to get to know it better.

Overall, Binance is easy to use, and we like how transparent it is with its fees — though they can rise a little high compared to other cryptocurrency exchanges. That said, the company has had some issues in the past with regulators, and we recommend that you don’t keep cash in the exchange unless you’re actively trading it.

Before you read on, note that trading crypto is incredibly risky even at the best of times. Crypto values can rise fast, but they can also plummet, leaving you wiped out. This risk is multiplied many times over should you start speculating in crypto derivatives, which Binance also offers. Keep reading this Binance review for full details on the exchange.

-

06/13/2023

We’ve updated this review to include information about the SEC lawsuit against Binance.US.

Binance Review: Pros & Cons

Pros:

- Easy to use

- Transparent fees

- Wide array of products

Cons:

- Some shady history

- Selling crypto is a pain

Binance Overview & Background

Like most crypto exchanges, Binance has a tumultuous history. Originally founded in China in July 2017, it was forced to move its operations just two months later when China made crypto trading illegal. Since then, Binance has been a company that operates nowhere but everywhere.

Binance briefly made its perch in Japan, then Malta — though that was news to the island state’s financial authority — and now, according to reports from the Financial Times, it is headquartered in the Cayman Islands. Meanwhile, CEO Changpeng Zhao, better known as “CZ” in the Binance community, has made Dubai his home.

In its short existence, Binance has made a name for itself in several ways. For one, it’s one of the biggest exchanges out there, with a market capitalization (a fancy term for its total value) that dwarfs most of its competitors. Only Coinbase and the fallen FTX breathe the same rarefied air.

However, Binance also showed up in the news in less positive ways. For example, there are allegations that Binance facilitated money laundering to the tune of hundreds of millions of dollars during its time in Malta. In December 2022 the news broke that U.S. prosecutors may be looking into charging CZ for multiple infractions.

Barely a month later, in late January 2023, it turned out that Binance had been aggregating users’ and the company’s assets, essentially mingling its own funds with those of some customers. Though it claims it’s an honest mistake, it does smack a little of the scandal that brought down FTX.

Binance vs Binance.US

Whatever the truth to the above allegations, one thing is for sure: plenty of governments don’t seem to trust Binance. The biggest blow came in 2019, when the U.S. government banned Binance for not complying with federal regulations, forcing the company to launch a new exchange for the United States alone.

This “new” exchange goes by Binance.US and is the only incarnation that is allowed to trade in the United States. Even so, it’s banned in four states — Hawaii, Texas, Vermont and New York. There are some important differences between regular Binance and its U.S. version for Binance users, too, something we’ll get into below.

Binance is also banned in the U.K. for regulatory reasons, though you can still use it to trade cryptocurrencies — at least, we had no trouble when we used a VPN to access Binance from a U.K. IP address.

Countries that have tussled with the company include the Netherlands, Canada and Germany, among others. As a result, you may want to check your government’s view on the service before opening an account.

The 2023 SEC Lawsuit

The Securities and Exchange Commission (SEC), which holds the power to regulate financial instruments in the United States, sued Binance, Coinbase (see our Coinbase review) and several other crypto giants in June 2023. The charges: Binance and the other defendants were selling securities without registering with the SEC.

Until now, nobody has been quite sure whether cryptocurrency counts as a commodity (a discrete object traded at a market price) or a security (a financial contract that has inherent value). The SEC is seeking to crack down on cryptocurrencies by classifying them as securities, but crypto supporters prefer them as commodities, which are far less regulated.

It’s too early to say exactly what long-term impact the Coinbase and Binance lawsuits will have, but it could be profound. Despite the SEC being a U.S. organization, this is far more than an American question. If the exchanges win, the crypto “Wild West” could receive official sanction. If the SEC wins, crypto’s freewheeling youth could be over.

So far, the main effects have been on prices at the crypto exchanges themselves. After the lawsuits went public, Binance.US lost a jaw-dropping 76% of its liquidity. It may not be a wise place to hold your assets until the state of the legal battle is more certain, though it could drag on for years.

Binance Features Overview

| Features | |

|---|---|

| Centralized Exchange | |

| Trade cryptocurrencies | |

| Trade NFTs | |

| Trade futures | |

| Trade options | |

| Trade derivatives | |

| Offers crypto staking | |

| Offers debit card | |

| Allows direct withdrawal | |

| Transparent fees | |

| Web/desktop app | |

| Mobile app |

Available Products

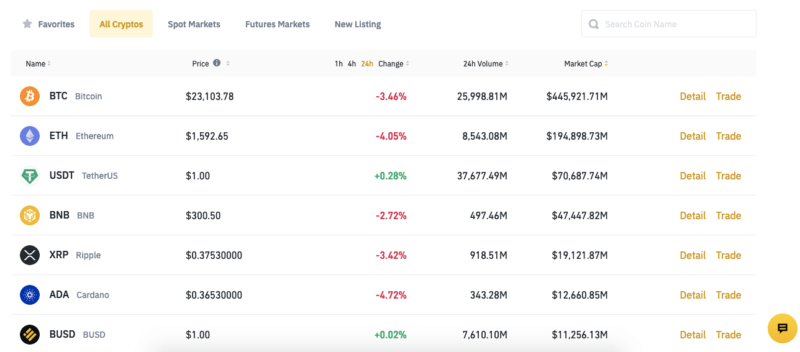

Binance offers literally hundreds of crypto assets, ranging from commonplace ones like Bitcoin, to NFTs, gaming tokens, stablecoins and stranger products. There’s also a Binance Visa card, which lets you load up some plastic with crypto.

You can find a full overview here for regular Binance; Americans should check the overview for Binance.US. To give you an idea, these coins were in the top three of the regular Binance’s spot market at the time of writing:

- Bitcoin (BTC)

- Ether (ETH)

- Binance Coin (BNB)

Besides being able to directly buy almost every coin and asset available, Binance also offers crypto derivatives. These include crypto futures (betting on the price of an asset in the future), crypto options (agreeing to buy or sell an asset at an agreed price at a certain date) or even leveraged tokens, which multiply the gains and losses from an underlying token.

Binance even offers crypto loans, where you effectively borrow money from other users, with Binance acting as the bank. Naturally, you pay interest on these loans. The most common use of these loans is margin trading, where you use the borrowed money to speculate on crypto; like with derivatives, caution is advised.

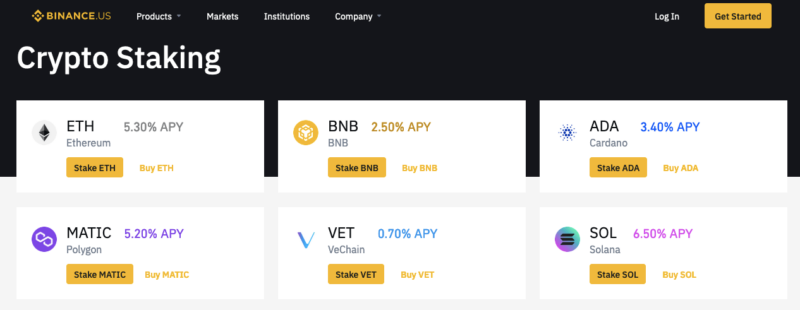

Staking on Binance

Binance also offers staking to its customers, allowing you and other investors to fund the operation of blockchain networks in exchange for “staking” a claim to a future block of crypto. It’s advertised as basically a crypto version of a high-yield savings account with fiat currencies, a secure investment you can count on.

Of course, like with all things crypto, there is inherent risk. Your returns will be affected by swings in the crypto market, such as 2022’s precipitous plunge. You also agree to lock up the staked funds for a certain period of time, so you may not be able to pull them out if the market drops quickly.

Trading Fees & Rates

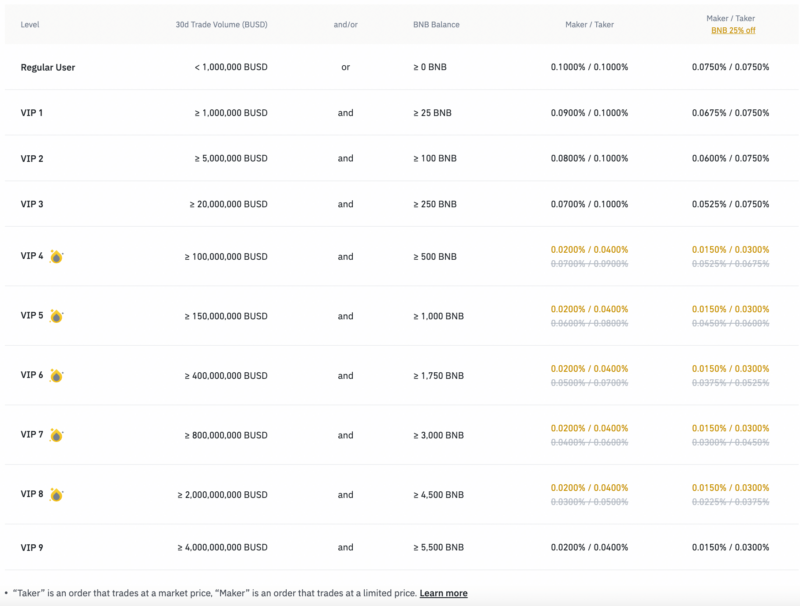

Binance’s trading fees are complicated but transparent (check out our Crypto.com review for an exchange with a similar approach). It works the same for both regular Binance and Binance.US, though the fees Binance enforces differ, with U.S. customers generally paying more.

Here’s how transaction fees break down for worldwide users, while this is the schedule for U.S.-based Binance users.

Looking at either of those pages will likely make your head spin, but it’s not too hard to explain. Basically, when you trade crypto on Binance, you’re placed in a category based on your trade volume per month. The higher your tier, the lower your spot trading fees, so somebody in the VIP 1 category is paying higher fees than somebody in VIP 2.

Other Ways to Get Binance Discounts

However, volume isn’t the only thing that influences your fee. It also depends on whether you’re a maker or a taker. Makers create buy or sell orders that can be filled at a later date. Since they pay money but take nothing right away, they create liquidity in the market and are rewarded with lower fees. Takers buy now and get now, taking crypto out of the market, and pay higher fees.

The upshot is that if you trade in larger volumes and are willing to trade in options, you pay less in fees than somebody who trades a little and puts all their assets into their own crypto wallet. On top of that, if you make your trades in BNB, Binance’s own coin, you get a hefty discount that can run as high as 25%.

User Experience

Using Binance is pretty easy overall, though it takes some getting used to thanks to the odd placing of the buttons and the even odder way in which tips pop up.

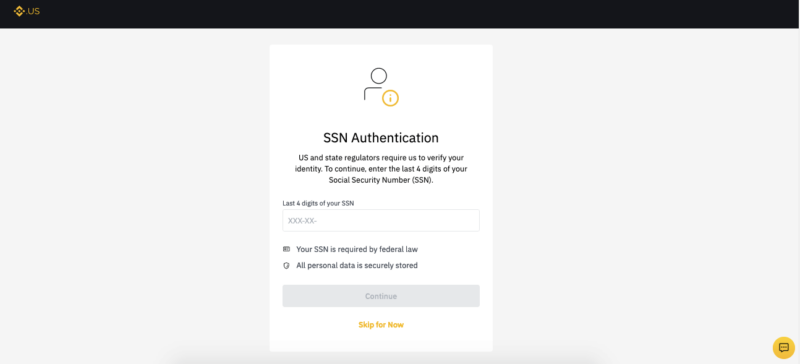

Signing Up for a Binance Account

Actually signing up is quick and painless. Basically, it’s a number of know-your-customer (KYC) steps you need to undertake, including showing your government-issued ID to the camera and following that up with a photo.

Once you’ve jumped through those hoops, you’ll get a message that it will take two days to verify your identity, but in our case it was more like 20 minutes. Overall, the signup process was smooth.

Crypto Trading on Binance

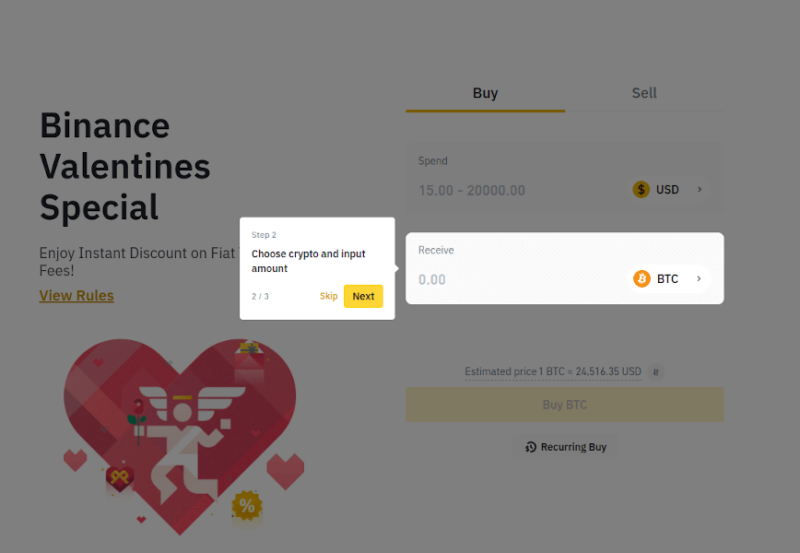

From there, trading on Binance is pretty simple. When you’re new to a screen, you’ll get pop-ups that guide you through what’s happening and what’s possible. It makes life easier, though it’s a little unpredictable when these messages will pop up, which can be a bit annoying.

Adding money is as simple as adding a payment method — you have more options than you can shake a stick at, including most kinds of plastic and PayPal — and then buying what you want. In the above example, we bought Bitcoin directly with fiat currency, but you could also first buy BNB and then buy other crypto to get that 25% discount.

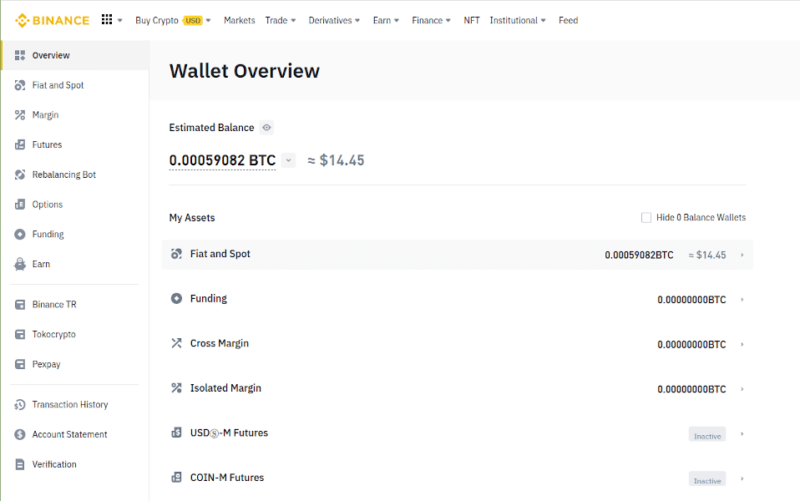

Probably the best thing about Binance is that each screen gives you lots of information. You always know where you stand and how much is in your wallet — though we recommend that you always use your own crypto wallet rather than rely on the one provided by the exchange. Compared to the mess that some exchanges offer, Binance is easy to use.

Withdraw Money From Binance

Selling your holdings is a different kettle of fish. At time of writing, Binance suspended bank transfers — the only way to sell crypto on the platform — due to regulatory issues. As a result, when we wanted to offload our bought crypto, we were sent to the P2P marketplace where third-party buyers and sellers do business.

Binance facilitates these trades, but takes no responsibility for anything, meaning you’re on your own to ensure you’re not getting scammed. Selling crypto via Binance is a bit of a minefield. As of now, there’s no indication of when Binance will be able to directly manage sales again.

Final Thoughts

Binance is an easy-to-use exchange that is very open about its rates and fees, which straddle the midpoint of the market. However, its history isn’t exactly spotless and selling crypto is pretty tricky. We recommend you exercise caution when investing with Binance and never leave money in its wallet.

What do you think of Binance? Have you used it? What was your experience? Let us know in the comments below, and thank you for reading.

FAQ

The original Binance website has been banned in the United States, but U.S.-based users can instead use Binance.US, which you can access from most states.

The Binance platform is as safe as any other crypto exchange, meaning there is inherent risk in speculating with these assets.

Binance was initially founded in China, but moved out of the country in 2017 when the government banned cryptocurrency trading. Currently, it’s reported to be headquartered in the Cayman Islands.

That entirely depends on how you look at it. Binance has more transparent fees than Coinbase, while Coinbase has a better interface (read Coinbase review).

The biggest issue is that you can’t currently use bank transfers on Binance, meaning the only way to actually get your money out of the exchange is to conduct an unregulated trade with a third party.