What Is Crypto Lending & How Do Crypto Loans Work in 2025?

Crypto lending platforms let investors stake cryptocurrency as collateral in exchange for quick, usually low-interest loans. We investigate how this works, how you can make money from it and whether it’s safe to try.

Key Takeaways: Crypto Lending Guide

- Crypto lending refers to using cryptocurrency as collateral for loans paid in fiat currency or stablecoin.

- Borrowers of crypto loans get lower interest rates and faster approvals but may lose their money in a margin call if the price of their collateral drops.

- Lenders can accumulate interest by letting exchanges use their crypto for loans. However, if the exchange collapses, lenders may not be able to recoup the value.

Anything with value can serve as collateral for a loan, and cryptocurrency is no exception. The lack of red tape for borrowers and the potentially huge returns for investors have made loans an extremely popular use for crypto assets. In this article, we’ll explain what crypto lending is, what you can get out of it and whether it’s safe.

As always, nothing in this article is intended to serve as financial advice. We suggest starting with any of our beginner’s guide such as crypto for dummies or what is CBDC if you’re still not sure about crypto overall.

Basics: Crypto Lending and Crypto Collateral

A traditional loan requires collateral: something valuable that the lender can seize and sell if the borrower defaults on the loan. For example, if you take out a mortgage, the house is your collateral — that’s why the bank can foreclose if you don’t make payments. A crypto loan is the same, except the collateral is the cryptocurrency you hold.

If you have cryptocurrency you aren’t ready to sell, you can put it to work by lending it out to borrowers; the interest you’ll receive is much higher than the typical yield of a savings account. On the other side, if you need a quick loan for a one-time expense, a crypto loan can get you the money a lot faster than a traditional bank.

These benefits don’t come without risks. Crypto prices are constantly volatile, and crypto lenders aren’t regulated or insured. On either side of the lending process, there’s a chance you’ll lose your initial investment and be on the hook for even more than that.

What Is Crypto Lending: Crypto Loans Explained

Crypto lending is the process of loaning money to borrowers who put up their own cryptocurrency as collateral. The money is usually disbursed as either fiat currency or a fiat-pegged stablecoin. The borrower then pays back the principal and interest over a period of time. If they can’t pay, they forfeit their collateral.

Much of the loaned money comes from other users of the crypto lending platform, who contribute their cryptocurrency in exchange for interest payments. These contributions are an important source of liquidity for the platform managing the loans. Exchanges may use it to pay out personal loans to borrowers, though they can also use it for other investments.

In an ideal world, crypto lending is a win-win-win. Borrowers get low-interest loans without long applications, investors get a high yield for very little risk and exchanges get regular cash infusions. However, in practice, the volatility of crypto and lack of oversight mean it rarely works out this way (see “Crypto Lending Risks” below).

Types of Crypto Loans

The most common kind of crypto loan is a collateralized loan of the sort described above. The value of a collateralized loan depends on how much collateral you can stake. Loan-to-value (LTV), the ratio of the loan amount to the collateral amount, is a key metric. Most loans have a maximum LTV, and lower LTVs tend to lead to better interest rates.

An uncollateralized loan uses an application and credit check as a substitute for collateral. These are harder to find since lenders prefer to have insurance in case of a default, but they do still happen.

A flash loan is almost never the best option for a retail investor, since it requires the funds to be borrowed and repaid in the same transaction. Flash loans are only possible if you can do something with the money that immediately makes you more than you borrowed — usually currency arbitrage, the act of profiting from varying currency prices in different markets.

Finally, some crypto lending services offer a crypto line of credit. Think of this like a secured credit card. The amount of collateral determines the total the borrower can withdraw, but how much they withdraw and when is entirely up to them. There’s also no repayment deadline; interest simply continues accruing on all the withdrawn money.

Crypto Lending Rates

The phrase “crypto lending rates” refers to two things: the interest paid by borrowers and the interest received by lenders. The exchanges that manage crypto loans can offer better borrowing rates than traditional banks — almost always below 10% per year and often as low as 0% during promotional periods. Like everything with crypto, it’s highly variable.

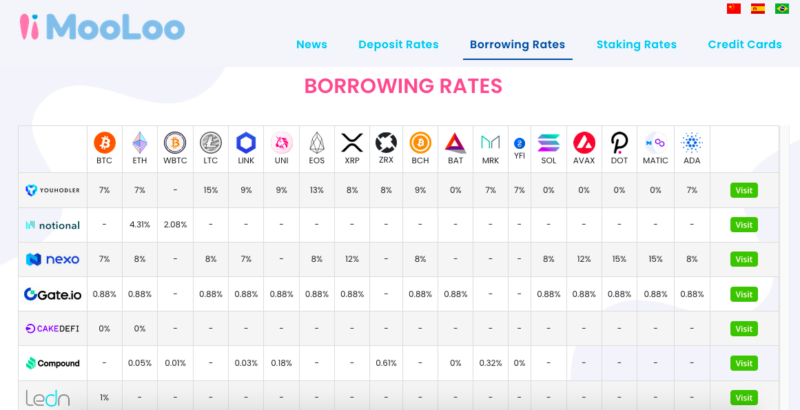

borrower interest rates on crypto loans, from 0% per year to as high as 15%.

At the same time, exchanges can entice lenders to stake their crypto assets by paying out much higher interest rates than traditional banks. Thanks to the rapid price fluctuations of even the most popular cryptocurrencies (including Bitcoin), these rates too are highly variable.

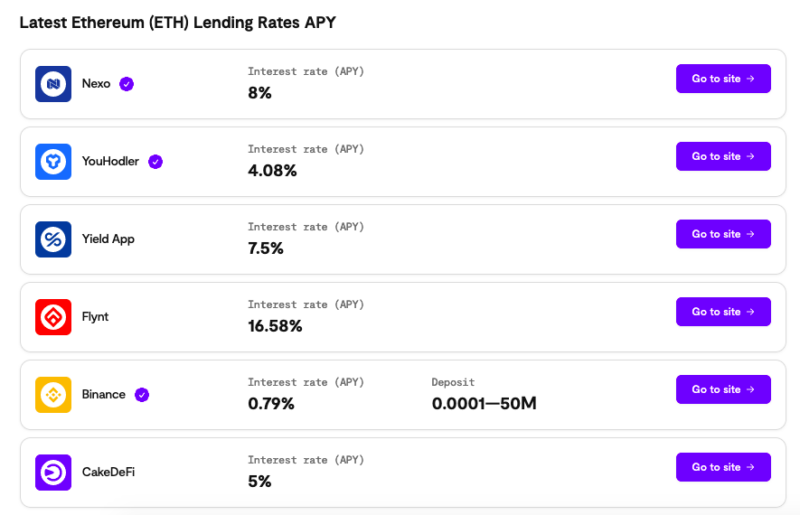

August 2023. Potential yields range from less than 1% to higher than 16%.

Since popular crypto lending platforms routinely charge lower rates to borrowers and pay out higher rates to lenders than traditional banks, it’s worth asking how they still make money on the deal.

The answer is that crypto borrowers default a lot more often than fiat borrowers, allowing platforms to make most of their profits from collateral liquidations. You can find more on that in the “Crypto Lending Risks” section.

Borrowing Cryptocurrency: How to Get a Crypto Loan

You have two choices to secure a formal crypto loan. The more common method is to go through a centralized finance (CeFi) platform, in which a third party provides the funds and guarantees the terms of the deal. These tend to mimic the process of an ordinary bank loan, though approvals tend to be a lot faster.

Centralized lenders offer lower risk and lower interest rates. Many of them are also attached to crypto exchanges, such as Gemini Earn (see our Gemini review). This adds the convenience of lending or borrowing through your established crypto wallet. However, thanks to recent regulatory actions, none of the best CeFi lenders are accessible in the United States.

Your other choice is to pick a decentralized finance (DeFi) platform. These lenders guarantee their loans through smart contracts — bits of code on the lender’s blockchain that run automatically when lenders and borrowers agree to a loan. For example, if payments are not made by a certain date, a smart contract can automatically liquidate the borrower’s collateral.

Decentralized lenders such as Aave, Compound and Fuji Finance are available in the U.S. since they’re extremely difficult to regulate. However, since oversight is even lighter than usual, they come with greater risks for all parties involved. Relying on a smart contract to guarantee your money with no human involvement is a dangerous proposition.

Crypto Lending Risks

As we’ve been alluding to for a while now, crypto lending can be just as costly as crypto investing if you don’t manage the risks. Both borrowers and lenders face serious potential losses if prices crash, exchanges go out of business or other adverse events strike. Here are the biggest potential pitfalls of crypto lending.

Exchange Defaults

BlockFi was formerly one of the top crypto lending firms in the world, combining a crypto exchange with high-yield accounts, credit cards and more. Yet barely a year after being valued at $3 billion, BlockFi filed for bankruptcy.

What happened? BlockFi was hit by a one-two punch. The U.S. government penalized it for selling securities without registering with the Securities and Exchange Commission, the same charges brought in the recent Coinbase and Binance lawsuits. At the same time, institutional client Three Arrows Capital defaulted on a multimillion-dollar loan, leaving BlockFi with no way to recoup the losses.

Lender defaults are a common risk across the crypto world. Most crypto companies are completely unregulated and often operate with high exposure — that is, risk that if a client fails, it’ll drag the lender down, too. Working on a knife’s edge is frequently the cost of being able to compete in the crypto space.

The sad truth is that there’s no perfectly trustworthy manager for crypto loans. Most of the institutions are less than 10 years old, and they aren’t backed by the FDIC like traditional banks. Anytime you hand your money to a crypto firm, there’s a chance you won’t get it back.

Margin Calls

If an investor stakes an asset as collateral on a loan and the price of that asset suddenly drops, the lender can no longer recoup their losses by selling it. To protect themselves, the lender may issue a margin call, requiring the borrower to either stake more collateral or sell some of what they purchased with the loan.

Crypto prices are prone to rapid swings, as the crypto exchange crashes of 2022 made clear. If the price of your collateral drops rapidly and you can’t afford to put up more, you may be left with nothing. This isn’t a hypothetical, either. As we covered above, margin calls are one of the main ways crypto lenders turn a profit.

Lack of Access to Funds

This risk falls on both borrowers and individual lenders — borrowers when they lock their crypto up as collateral and lenders when they loan their crypto to make passive returns via interest. Both require a certain time period during which you own some crypto but can’t access it.

If the price of your currency rises while it’s locked up, you may not be able to take advantage of the spike. Similarly, if you lose money on another investment, you can’t transfer illiquid crypto to cover it. Play the crypto lending market and you’ll frequently be kept from spending money that’s technically yours.

Final Thoughts: How Crypto Lending Works

Just like every other aspect of decentralized finance, crypto lending finds itself in a difficult spot. It’s almost universally banned in the U.S., the world’s biggest financial market, and high-profile collapses like BlockFi are casting doubt on the whole endeavor.

Even knowing all that, though, there’s still money to be made if you’re smart about it. Never put any funds in crypto that you can’t afford to lose — it’s essentially gambling, so think of it like a slot machine. Don’t get complacent with crypto lending, staking and other passive-earn products just because they feel less volatile than spot trading.

If you’ve participated in the crypto lending process as a lender or a borrower, we’d love to hear your story, especially if you made or lost a lot of money. Tell us all about it in the comments. Thanks for reading!

FAQ: Crypto Lending Guide

Depending on the platform and assets you choose, you can make up to 15% annual returns lending crypto. However, gains aren’t guaranteed; lender interest rates have been known to drop far into the negatives.

Participants take on significant risks to make crypto lending work. Lenders lose access to their funds for a predetermined period. If the exchange fails, which happens frequently, there may not be enough liquidity remaining to pay lenders back.