Coinbase Review

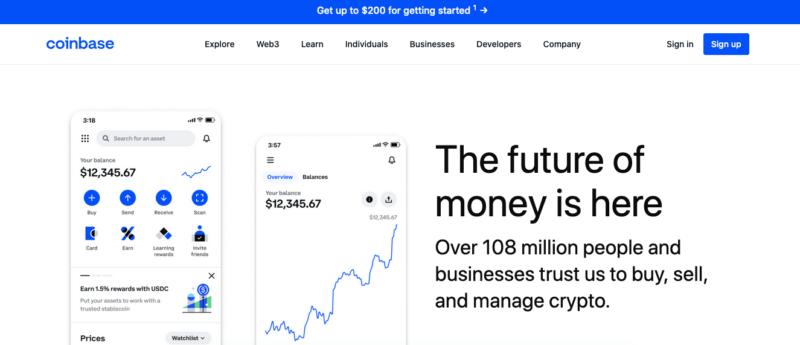

Coinbase is one of the biggest crypto exchanges out there, making it an attractive option for anybody new to cryptocurrency trading. Let’s see if it’s the right choice for you in this Coinbase review.

As one of the biggest cryptocurrency exchanges, Coinbase has been the first port of call for plenty of new investors. Does it deserve the attention, though, or should you think twice before opening up an account? We’ll go over all the site’s ins and outs in this Coinbase review.

Key Takeaways: Coinbase Exchange Review

- Coinbase has had fewer regulatory issues than many other cryptocurrency exchanges, though it’s not entirely free from scandal.

- It has one of the best interfaces we’ve seen, making it very easy to understand what’s going on.

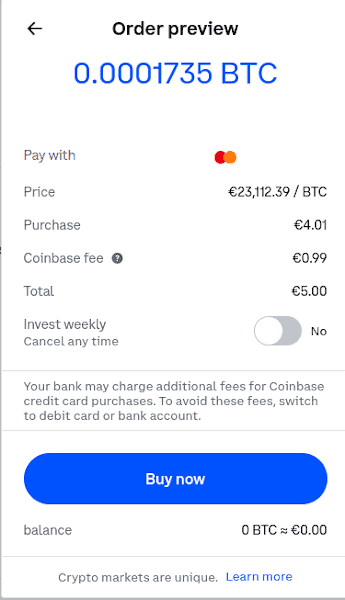

- Coinbase’s fees are high, and the company isn’t very clear where the thresholds lie, so you need to check for every transaction what you’re paying.

Overall, there’s a lot to like about Coinbase: it’s easy to use and has had fewer regulatory issues than most of its competitors. However, its fees are high compared to other cryptocurrency exchanges and the company isn’t very open about them. As a result, it may not be the best choice for lots of small trades.

-

06/13/2023

We updated the review to include information about the SEC lawsuit against Coinbase.

Before you go on, know that to trade crypto is incredibly risky even at the best of times. Crypto values can rise, but they can also plummet, leaving you wiped out. This risk is multiplied many times over should you start speculating in crypto derivatives.

Coinbase Review: Pros & Cons

Pros:

- Publicly traded company

- Great interface

- More regulatory compliant

Cons:

- High & opaque fees

- Reports earnings to the IRA

- Was hacked in the past

Overview & Background

Coinbase is based in the United States, where it’s a publicly traded company, meaning it has stocks and shares that anyone can buy. Coinbase has a reputation among crypto users for following regulations since its inception; being the “safe option” has become a key part of its brand.

Part of its squeaky clean image is the fact that the company tells the IRS when Coinbase users have passed the reporting threshold. This is the point where they should declare their crypto income on their tax forms.

This has earned it a lot of hate in the crypto community, with more than one Reddit thread overflowing with vitriol toward the company. Though we understand nobody likes paying taxes, we’re not going to ding Coinbase for complying with the laws of its home country. Still, if you’re in the U.S., it’s something to keep in mind.

It should be noted that Coinbase’s clean reputation doesn’t always hold up under scrutiny. In January 2023, Coinbase settled out of court with regulators for not properly following anti-money laundering regulations.

The Coinbase Hack & Crypto Winter

Like most other exchanges, Coinbase has been the target of a successful hack. In October 2021, as many as 6,000 customers saw their crypto holdings evaporate. Afterward, the company faced some bitter accusations that customer service was severely lacking. There have been other successful (though less severe) attacks as recently as February 2023.

(As an aside, this is why you should hold your digital assets in your own crypto wallet.)

Also, Coinbase has not been immune to the crypto winter: in January 2023, it laid off 20% of its workforce — almost 1,000 employees — to better “weather downturns.” Around the same time, rating agency Moody’s also downgraded Coinbase’s status, citing reduced revenue and cash flow.

The 2023 SEC Lawsuit

In June 2023, the U.S. Securities and Exchange Commission (SEC) announced a lawsuit against Coinbase. It wasn’t the only crypto entity hit, either — Binance was also sued, which you can read more about in our Binance review. No matter how these cases resolve (and it could take years), both cases will change the course of cryptocurrency.

To summarize: the SEC alleges that Coinbase is selling securities and pretending they’re commodities. Commodities are objects bought and sold at market prices; they’re usually physical, though currencies can also count as commodities. Securities only exist on paper. Any financial contract with value counts as a security, including stocks, bonds, options and futures.

In the U.S., the SEC regulates securities, while commodities are regulated by the more limited Commodity Futures Trading Commission (CFTC). Crypto enthusiasts prefer to classify cryptocurrencies as commodities because securities have a much tighter regulatory structure. Being considered a commodity is what has allowed crypto to expand until now.

Depending on how the court finds, the era of crypto exchanges going essentially unregulated could be over. The lawsuit had an immediate impact, as Coinbase’s stock price dropped 14% following the news.

Coinbase Features Overview

| Features | |

|---|---|

| Centralized Exchange | |

| Trade cryptocurrencies | |

| Trade NFTs | |

| Trade futures | |

| Trade options | |

| Trade derivatives | |

| Offers crypto staking | |

| Offers debit card | |

| Allows direct withdrawal | |

| Transparent fees | |

| Web/desktop app | |

| Mobile app |

Available Products

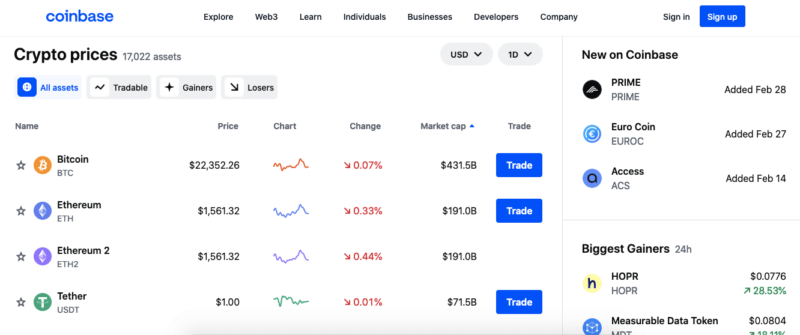

None of this seems to have dampened Coinbase’s enthusiasm for its core product, and at the time of writing it offers a wide array of services. At its heart, you’ll use Coinbase to buy and sell crypto assets. Currently, it offers just over 9,000 (yes, really). Here are Coinbase’s five biggest sellers:

- Bitcoin (BTC)

- Ethereum (ETH)

- Ethereum2 (ETH2)

- Binance coin (BNB)

- Aave interest-bearing USDC (aUSDC)

Besides these, you can also trade in NFTs, stablecoins and plenty more besides. Coinbase also lets you do some more advanced things with your cryptocurrencies. For one, if you leave them in the exchange, you can earn a small percentage off them: up to 6% according to Coinbase’s promotional material.

You can also use them to stake future currencies, essentially putting up money for when future blocks of a cryptocurrency are released.

Naturally, you can engage in trading in crypto derivatives, including futures — betting on the future price of an asset. You can even mess around with crude oil futures, if you like. Margin trading was offered in 2020 but discontinued after federal guidelines changed.

On top of all this, Coinbase also lets you borrow money using your crypto as collateral, and even lets you load up your own plastic with the Coinbase debit card. As you can see, Coinbase has a bit of everything; only Binance offers a more complete package of services.

Trading Fees & Rates

So far, Coinbase may seem like a good bet, but there’s one massive issue with the exchange: namely, that it’s not very open about its fees. In fact, only two hard numbers are mentioned on its fees page: staking, and recovering unsupported currencies. The more common transactions, like simply buying or selling coins, or betting on futures, operate with variable fees.

Even people that have dug a little deeper into how Coinbase fees work have come up with nothing concrete. In the end, you won’t really know what you’re paying until you finish up your transaction.

Though overall Coinbase’s fees seem lower than that of many other exchanges, it’s all so vague that we don’t recommend you count on this. Even Coinbase Advanced Trade — a special plan a step up from regular users, replacing the phased-out Coinbase Pro — won’t save you fees. This is a big difference from other exchanges, which usually will lower fees if you step up to an advanced plan.

User Experience

Coinbase is pretty easy to use, with one of the more pleasant interfaces we’ve come across while reviewing the best crypto exchanges — check out our Crypto.com review for one bad example.

Signing Up for a Coinbase Account

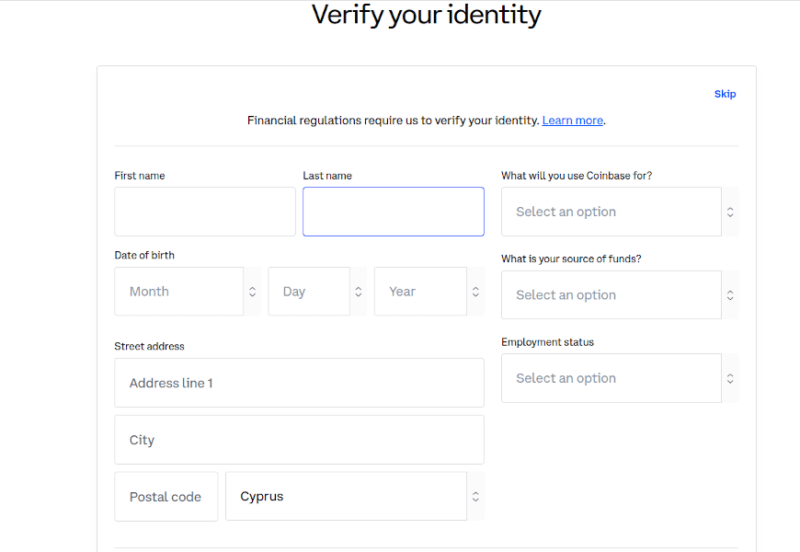

Signing up to Coinbase is pretty easy, though the know-your-customer procedures were a bit more involved than with other exchanges. Besides needing to enter all our personal information, we had to verify it not just with a passport, but also a utility bill proving our address.

Coinbase is also more stringent in requiring users to turn on two-factor authentication, which requires your phone number. This is good, but it also means that the company has your digits, which it uses to send highly annoying push notifications. There’s no good way to switch this off, either, aside from blocking the number.

Crypto Trading on Coinbase

Once you’re through the initial gauntlet, all you need to do is add a payment method and you can start trading — you can use PayPal, a credit or debit card, link a bank account and a few other options. Chances are, Coinbase may ask you to verify your identity one last time at this stage. It’s a little aggravating, but it does go mercifully quick.

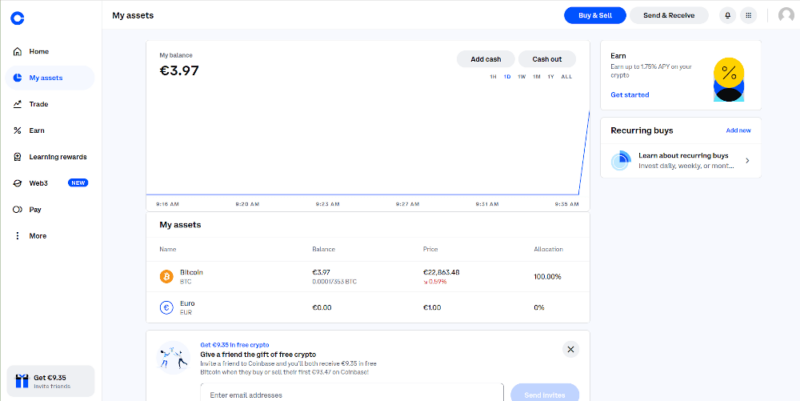

Once you go into Coinbase, the first thing you’ll see is your wallet and an overview of all your activity. We really like this interface: it’s very clear what’s what and it’s highly responsive without any glitches or other issues. Other exchanges could learn a little from Coinbase in this respect.

Buying Bitcoin or other assets is easy. Simply select the one you want, hit the option to buy, say how much you want to spend and you’re done. Coinbase deducts its fees from your end, so don’t worry about the eventual amount being higher. That said, since fees are a secret up to this point, they can sting a little.

Even better, Coinbase makes it very easy to sell coins: just click “sell” instead of “buy” and, well, that’s it. Other exchanges could definitely learn from this.

Final Thoughts

Overall, Coinbase has a great user experience. As a result, it’s a lot less scary to get into than other exchanges. However, its fees are an issue: they’re a bit high and its lack of transparency should give you some pause. There are also some regulatory issues, with Coinbase having settled legal trouble with regulators at least once.

What do you think of Coinbase? Is it any good, or are there better exchanges? Which one has better fees, you think? Let us know in the comments below and thank you for reading.

FAQ

Sure, as much as you can trust any cryptocurrency exchange. Since there’s little regulation, you’re taking all of them at their word.

Coinbase has a beginner-friendly interface.

Coinbase’s biggest downside is that it’s not transparent what its fees are, making it hard to gauge what any transaction will cost you.

Coinbase has a very simple sales system that lets you sell your cryptocurrency with a single click.