Kraken Review

Among crypto exchanges, Kraken is a mixed bag. It has a friendly interface and plenty of assets on offer, but hidden fees and SEC penalties drag it down. In our Kraken review, we’ll unpack all the pros and cons.

Key Takeaways: Kraken Crypto Exchange Review

- Kraken is one of the oldest crypto exchanges and has a strong security record. Although it’s never been caught in FTX-style mismanagement, it has been accused of misrepresenting securities and promoting a hostile work culture.

- Kraken has a basic interface for beginners and a separate Kraken Pro interface for more experienced traders. Margin trading and futures are only available on Kraken Pro.

- Because of SEC penalties, Kraken no longer offers staking in the United States. Futures are unavailable in several countries.

In this Kraken review, we’ll take a look at a crypto exchange that targets the beginner market. Its trading platform follows the simple, user-friendly design cues of a software-as-a-service app. In late 2022, Kraken launched a new interface for advanced traders called Kraken Pro, while retaining its basic app for trading beginners.

Basic Kraken users can buy, convert and sell bitcoin and other cryptocurrencies to make money the (relatively) easy way. Meanwhile, Kraken Pro users can dive into more complex things like spot trading and margin trading. Kraken complements this convenient split with strong security and the ability for any verified user to hold fiat currency without buying crypto right away.

However, there are some downsides to Kraken. Fees crop up everywhere, especially on the basic interface, and it’s one of the few exchanges to charge any conversion or deposit fees. It has also faced its share of scandal, including a recent Securities and Exchange Commission (SEC) penalty that led it to withdraw its staking products from the U.S. altogether.

Before you go on, know that crypto trades are incredibly risky even in the best of times. Crypto values can rise, but they can also plummet, leaving you wiped out. This risk is multiplied many times over should you start speculating in crypto derivatives.

Kraken Review 2025: Pros & Cons

Pros:

- Very secure exchange

- User-friendly interface

- Holds fiat currency in wallet

Cons:

- Big fees on basic transactions

- No U.S. staking products

- Learning curve for Kraken Pro

Overview & Background

Kraken was founded in 2011. Co-founder Jesse Powell had worked as a security consultant for Mt. Gox, an exchange that was once the nexus of the crypto world, but collapsed after its weak security couldn’t stand up to an onslaught of hackers.

Powell and his co-founder Thanh Luu positioned Kraken to fill the hole Mt. Gox had left. He accomplished his mission of building a secure crypto exchange; Kraken was already so hack-proof by 2015 that U.S. regulators enlisted its staff to recover the bitcoin (see what is bitcoin) lost in the Mt. Gox collapse. Eight years later, Kraken still hasn’t been hacked.

However, despite staving off cybercrime, Kraken has faced a slew of other problems. The government has fined it several times for offering unlawful securities, culminating in a $30 million penalty when the SEC found its staking products violated financial regulations. The case could set off a domino effect that prevents other exchanges from offering staking in the U.S.

Powell has also faced criticisms for creating a hostile work environment by forcing his employees to take sides in a culture war. At least one employee has sued Kraken for wrongful termination, and the company laid off 1,100 employees in November 2022.

Coins Available

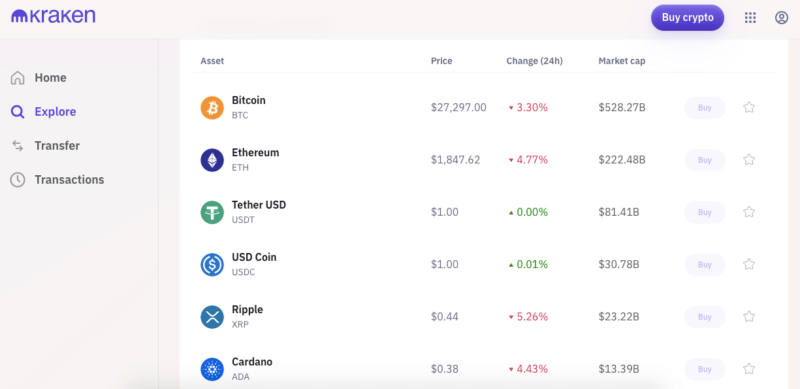

Kraken trades just over 200 crypto assets, a far cry from some of its competitors — KuCoin, for example, trades about 700, as you can see in our KuCoin review.

At the time of writing, these were the top 10 on Kraken by market cap:

- Bitcoin (BTC)

- Ethereum (ETH)

- Tether USD (USDT)

- USD Coin (USDC)

- Ripple (XRP)

- Cardano (ADA)

- Dogecoin (DOGE)

- Polygon (MATIC)

- Solana (SOL)

- Polkadot (DOT)

It’s hard to tell what types of assets Kraken offers, as it jumbles them all together in the same list. A quick survey revealed popular choices like Bitcoin and Ethereum, along with stablecoins such as Tether, plus many lesser-known picks in the bottom half of the menu.

One thing to beware of when scrolling through Kraken’s list of offerings is that it doesn’t always seem to report market caps accurately. Market caps fluctuate all the time, but several currencies, including Ethereum 2 and Flare, were listed with caps of zero. Prices, however, seemed to be mostly accurate.

Trading Fees & Rates

There are two main ways to buy crypto on Kraken. You can use something called “instant buy,” which is quite a bit simpler, or you can go through the Pro interface. Instant buy is aimed at new traders; while it includes all the coins available on Kraken, you’ll pay dearly for the friendlier control panel.

Each Instant Buy transaction is charged a flat trading fee: 0.9% for stablecoins and 1.5% for all other assets, plus an extra 0.5% if you buy via bank transfer (which Kraken recommends). The full 2% works out to about 30 times more than you’d pay on Crypto.com — we don’t love that exchange, but at least it’s affordable, as you can see in our Crypto.com review.

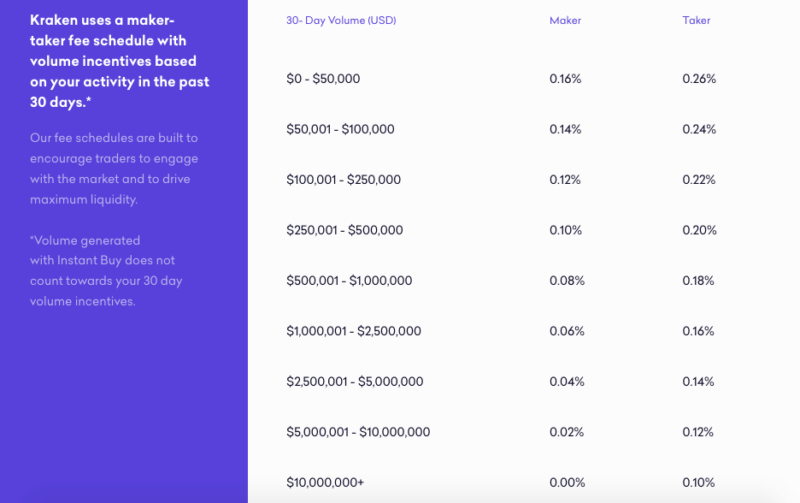

For Kraken Pro traders, there’s a more traditional fee structure, pictured below. The low trading fees here are significantly more reasonable, far below what you’d pay on Coinbase (see its full fee structure in our Coinbase review).

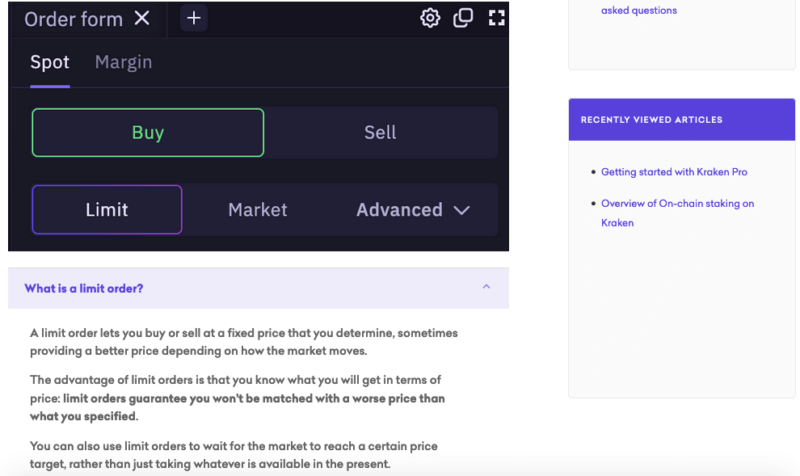

Kraken Pro determines fees through a rank structure. Crypto trades are its product, and like many dealers in a product, Kraken provides bulk discounts; the more you trade in a 30-day period, the lower your trading fees overall. Trading under $50,000 will cost you between 0.16% and 0.26%, while trading more than $10,000,000 can be free under the right conditions.

Trading fees vary depending on whether you’re a maker or a taker. A maker submits purchase orders that go into Kraken’s order book, putting money into the cryptocurrency exchange and getting lower rates in return. A taker buys cryptocurrency immediately at market price, which doesn’t add liquidity and consequently costs more.

Unlike some other platforms, such as OKX (see our OKX review for details), it’s not possible to trade on Kraken at such a high volume that the exchange actually pays you. You can get your maker fees down to 0%, though.

User Experience

Let’s talk about how it feels to actually trade crypto on Kraken.

Signing Up for a Kraken Account

The basic sign-up process for Kraken is as simple as registering for any web app. All you need is an email address and a strong password. You’ll be able to explore its newbie-facing features moments after you get started.

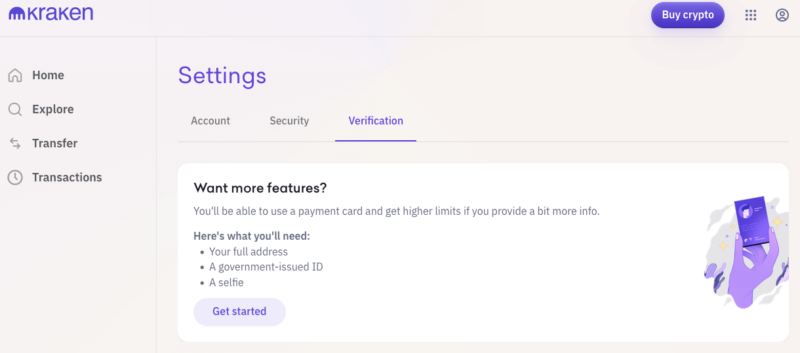

However, making use of most Kraken features requires that you complete a know-your-customer (KYC) process. You’ll have to be OK with handing over a few sensitive details, including your home address and the last four digits of your social security number.

To get the last set of privileges, you’ll have to go through more intensive verification, providing a government ID and a photo of yourself. It took us no more than a few minutes to complete.

Finishing full verification unlocks the ability to pay with a credit card, skyrockets your ACH purchasing limits to $100,000 per day, allows crypto deposits and withdrawals, and opens up staking and margin trading.

Crypto Trading on Kraken

As we alluded to in the “trading fees” section, Kraken is really two different crypto trading apps. There’s the instant trading page for newbies and the veteran-oriented Kraken Pro. Kraken isn’t the only exchange with such a split, but it leans into the divide further than most.

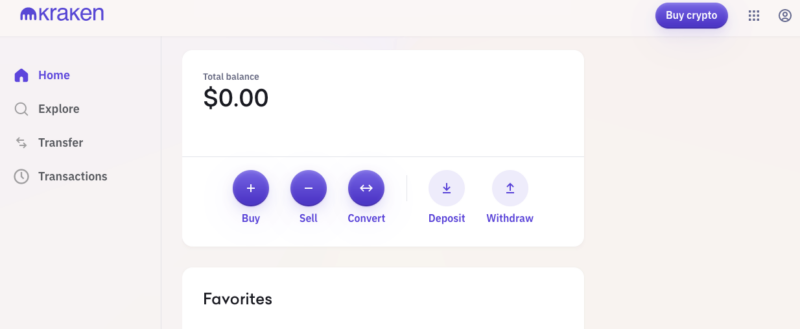

When you first create your account and log in, you’ll start on the basic platform. Scroll down past the Bitcoin ad and you’ll reach a wallet with five functions.

Kraken Buy & Sell

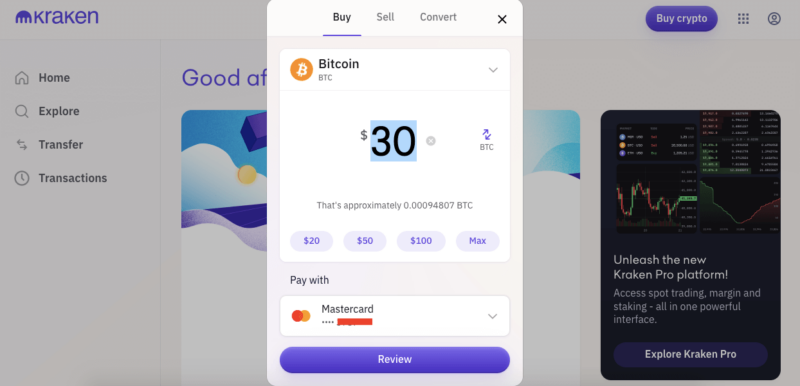

The “buy” button takes you to a window where you can select a cryptocurrency to purchase. You can either enter the amount of fiat currency you want to spend (minimum $10) or the amount of crypto you want to buy (minimum varies by coin; 0.00003 BTC for bitcoin). Select a payment method, adding one if you haven’t already, then click “review” and “confirm.” That’s it.

It’s worth noting that buying is far easier if you go through verification and add a credit or debit card. If you transfer from a linked bank account, your bank has to be a member of Trustly; otherwise you may have to personally arrange the cash transfer over the phone.

The “sell” button works like buying in reverse. Enter the amount of cryptocurrency you’d like to sell or the amount of fiat currency you’re hoping to recoup. Review the sale and associated fees, then click confirm. You’ll receive the results of the sale as credits in your default fiat currency. It’s smooth and significantly easier than on Binance (see our Binance review).

Kraken Convert, Deposit & Withdraw

The “convert” button near-instantly turns one crypto asset into another at the current exchange rate for that trading pair. Unlike many of its competitors, Kraken charges conversion fees. The actual fee schedule is hard to find, but seems to vary based on prices and various market factors.

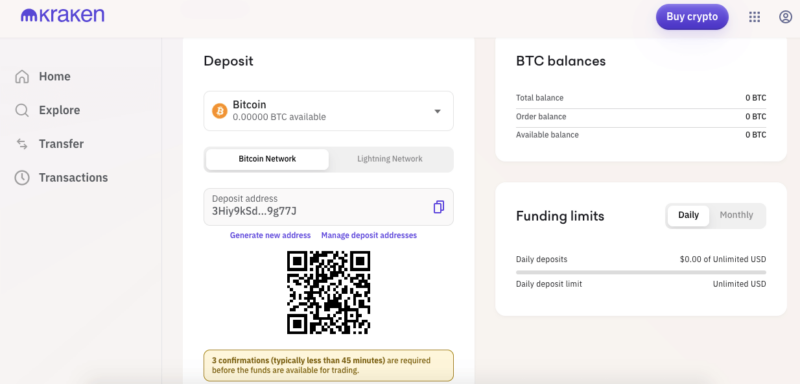

You can deposit cryptocurrency into your Kraken account from a third-party wallet by copying a deposit address, or withdraw it by entering a third-party address. You can also deposit and hold fiat currency, which not all exchanges allow — Kraken supports U.S. dollars, Canadian dollars, Australian dollars, British pounds, Swiss francs and euros.

Like every other transaction on Kraken, deposits and withdrawals can incur fees. Though most deposits are free, a few currencies cost money to add, including Ethereum Classic, Flare and Avalanche. Almost every currency costs a fee to withdraw, except for bitcoin withdrawn through the Lightning Network.

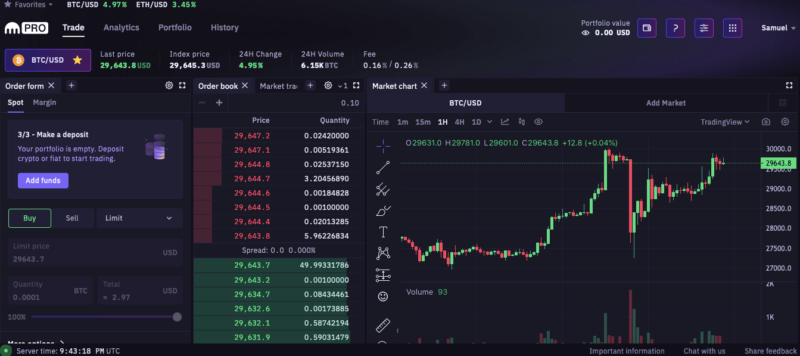

Trading With Kraken Pro

You can use the basic interface to see a record of your transactions and browse the full list of available coins. To do anything else, you’ll have to move over to Kraken Pro. You can find it by clicking the nine dots at the top right of your screen.

Kraken Pro takes off the training wheels and reverts to a classic spot trading interface. This starts out looking somewhat frightening, but you can customize it to make it easier to parse. Drag and drop the panels to store them behind other panels, or close them out altogether and reopen them from the settings menu. It’s all more user-friendly than it seems at first.

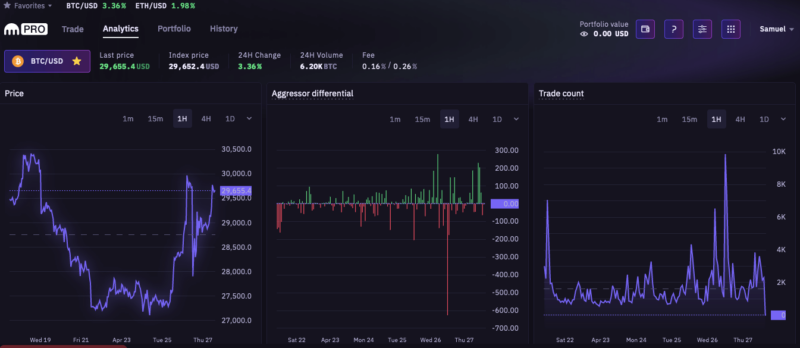

Unfortunately, the three tabs other than “trades” — “analytics,” “portfolio” and “history” — are not nearly as customizable, and rely more on insider knowledge. This reinforces the feeling that Kraken Pro is more for people who cut their teeth on other exchanges than for those who started with Kraken.

Kraken Analytics, Portfolio & History

The “analytics” tab offers graphs about the trading pair currently selected, including its price, the amount and value of trades, its historical volatility and more. The “portfolio” tab shows the total value of your holdings, including movement over time. Finally, the “history” tab shows all the transactions you’ve made on Kraken.

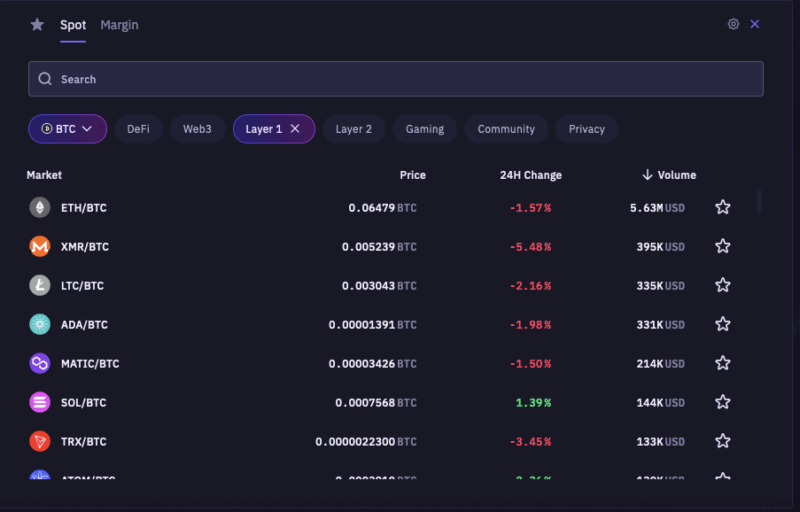

One place where Kraken Pro has a clear advantage over basic Kraken is in the searchable list of crypto assets. Instead of lumping them all into a single list, it divides them into groups, letting you quickly jump from one to the next to view relevant analytics. It may still put off non-experts, though, as coins are only shown as their abbreviations and symbols.

You can also use this menu to switch over to margin trading, where the interface is similar. Futures trading occurs on a completely separate dashboard, which you can find at futures.kraken.com. You’ll have to create a new account and verify that you’re not in a banned country to participate in crypto futures trading.

Kraken futures trading is unavailable in several countries, including the U.S., Canada, the U.K., Australia, Spain and Singapore (full list here). Since we’re based in the U.S., we weren’t able to check it out in-depth.

In addition to Kraken and Kraken Pro, there’s also a totally separate market for non-fungible tokens (NFTs) that can be found at nft.kraken.com. As always, be wary of NFT scams.

Staking on Kraken

Kraken offers on-chain staking, a popular product that offers passive crypto income for less risk than trading. Users can lock up some money from their wallets to temporarily fund the operation of a blockchain (check out our article on blockchain for more about how it works). In exchange, they get a stake in newly mined coins from that chain, like a high-yield savings account.

In February 2023, Kraken was fined $30 million by the SEC and forced to stop offering staking products in the U.S. According to SEC rules, any company offering yields as large as Kraken promised (up to 20%) needs to take measures to protect customer investments; Kraken failed to prove it was taking these steps on behalf of crypto investors.

Users in the U.S. no longer have access to staking or any other kinds of rewards, such as loans or crypto savings accounts. In other countries, you can still stake currency for rewards, with yields that generally range between 4% and 12%.

Customer Support

Kraken’s divided nature extends to its learning and support resources. If you start with basic Kraken, there aren’t many resources that will help you make the leap to Kraken Pro. People accustomed to the initial hand-holding won’t find anything to help them clearly understand concepts like the aggressor differential or rolling volatility.

With that said, the content that shows you how to use the Kraken platform — as opposed to educating you about crypto in general — is quite good. Knowledgebase articles are organized and written sensibly, with little jargon and plenty of pictures.

Other help options include live chat, email support tickets and a phone line. All of these are available 24/7, though there may be waiting periods.

Final Thoughts

Kraken is an odd duck. Despite launching less than two years after Bitcoin itself, it’s gone all that time without a major hack. Although it’s been fined multiple times, those violations were about how it packages its products, not for any specific malfeasance. There’s an argument to be made for it being the most trustworthy crypto exchange.

On the other hand, its hostile work environment is a concern — not just on moral grounds, but also because an unhappy staff cuts corners. It has one of the most beginner-friendly interfaces we’ve ever seen, but discourages its use with a smorgasbord of vaguely defined fees.

We’d recommend Kraken to seasoned traders concerned about hacking. We also conditionally recommend it to beginner crypto investors. It’s a good way to learn, as long as you understand you’ll be paying extra for the privilege.

How was your experience with Kraken? Do you agree or disagree with our review? Point out anything we missed in the comments below. Thanks for reading.

FAQ: Kraken Review

Kraken has been operating for more than a decade, and hasn’t been hacked or caught misusing customer money. While it has faced scandals, including violating SEC rules with its staking products, none of those have directly related to unsafe uses of customer funds.

Yes, you can store both crypto and fiat currency in an on-chain Kraken wallet.

Kraken is licensed to operate in the U.S., and verified users can engage in spot and margin trading. However, staking and futures are not available.

Yes, Ripple (XRP) is available to trade on Kraken.