What Are NFTs & How Do They Work?

Non-fungible tokens took the world by storm a year ago, dominating coverage on major news channels, followed by people pouring millions of dollars into them. What are NFTs, though, and how come you hear a lot less about them now?

A year or so ago, NFTs were heralded as the future of art, a new way to do business, in short a revolution in all things digital, powered by blockchain technology. Now, though, the NFT market is moribund, a footnote of history brought up as a punchline at cocktail parties. What are NFTs, though, and what’s the story behind their rapid rise and fall?

Key Takeaways: What the Heck Are NFTs?

- NFTs are a type of digital asset that’s supposedly unique, making them very interesting for collectors and investors.

- Once NFTs started gaining mainstream attention, their price rose to huge heights. People ending up shelling out millions for NFTs that were promised to be created down the road.

- Unsurprisingly, this massive speculative bubble burst after a few months, leading to losses for many and a general loss of interest in NFTs as a whole.

- Currently, the future of NFTs is uncertain, though, as with all things crypto, there is a group of dedicated crypto users still hard at work finding uses for NFTs.

Turns out that NFTs aren’t quite as amazing as the luster of marketing would have you believe. Powered by the same speculation that has seen cryptocurrency oscillate wildly, NFTs turned out to be the perfect arena for grifters, mountebanks and other digital snake-oil salesmen. Scams abounded, suckering many into paying thousands, which then simply evaporated.

NFTs have all the hallmarks of financial bubbles throughout history, but with an added twist for the new century: the tech underpinning NFTs was iffy at best.

On top of that, there were legal questions surrounding these digital assets, particularly issues of copyright. Let’s take a look at all these problems and see how they contributed to NFTs’ spectacular crash.

What Are NFTs?

Non-fungible tokens are a type of digital asset — the “token” part of the term. The “non-fungible” part is a bit trickier and is a term usually used in financial circles. Fungible means that an asset is interchangeable with one like it.

For example, a banknote is fungible: if you have two $5 bills in your pocket, and you go to buy a cup of coffee, the barista won’t care which of those two bills you pay with; either one will do. Most currency, including cryptocurrency, is fungible. One bill, coin or token is the same as every other one.

From this follows that when something is non-fungible, it can’t be swapped out with others of its class, making it one of a kind. An NFT thus is a unique token. Only one can exist at any one time. It’s something that can’t be reproduced and is therefore more comparable to something like a work of art than a coin.

How Are NFTs Used?

As a result, NFTs are often used as collectibles or digital artwork. They’re hugely popular in gaming, with a whole type of games, called play-to-earn or P2E, popping up. In these games, players earn NFTs which can then be traded or sold.

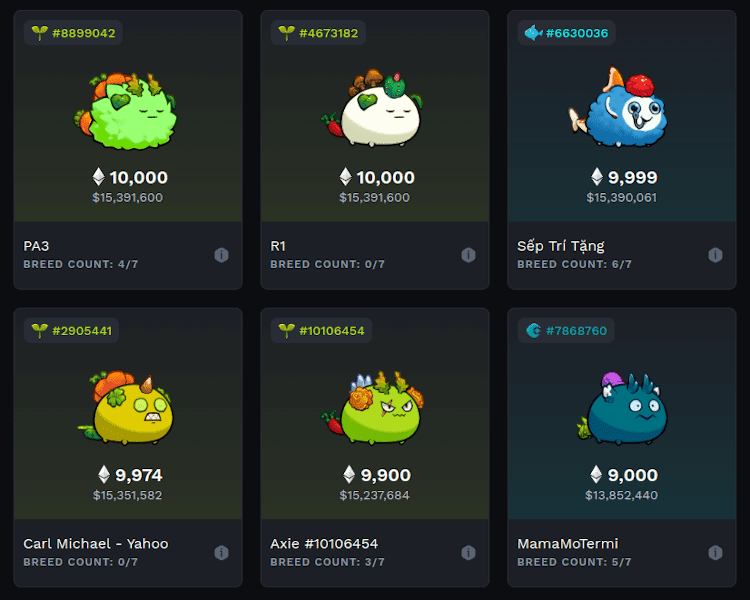

The biggest example is probably Axie Infinity, where you “breed” creatures, the titular axies, and battle them with others. The critters themselves are NFTs and can be traded or exchanged on the internal marketplace for the game’s very own cryptocurrency, AXS, which can then be sold for real-world money.

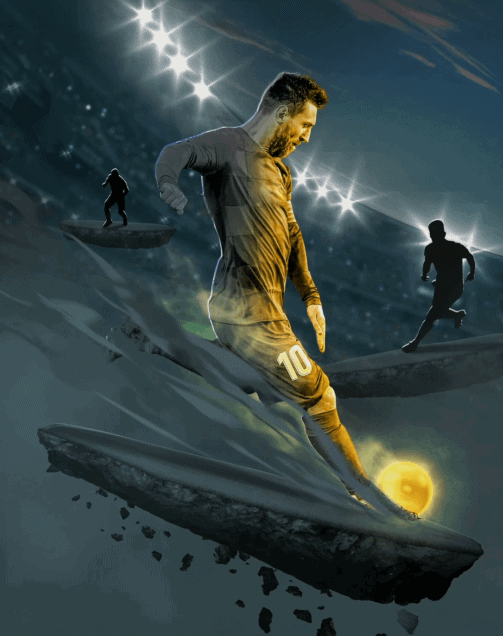

The way NFTs gained the most attention, though, is as digital art. There are many examples of NFT collections, including a soccer-themed one called the Messiverse, a set of pictures made by Australian artist BossLogic that features Argentinian soccer player Lionel Messi in all manner of poses.

The most famous set of NFT artwork is probably the Bored Ape Yacht Club, where NFT art serves as a collector’s item and club membership card all at once. The apes in question are pictures which follow a template — the ape’s clothes, accessories, etc. can change — but are all different from one another.

The Bored Ape Yacht Club has members that span the gamut, from NFT artists, to crypto fans, to celebrities. For example, rapper Eminem and comedian Jimmy Fallon are members, to name but two.

For more details on who owns NFTs and other assorted facts, plus a detailed history of these tokens, check out our NFT statistics.

How Do NFTs Work?

With so many famous people involved, you’d figure that the way NFTs work is pretty solid, with defined rules and regulations. That never has been the case, though. For one, it’s always been tricky to determine who owns an NFT, and what an NFT even is.

For example, above we’ve used images of several NFTs. Now, it’s not like we went out and bought any of them, we simply did what everybody on the web does: you download an image, attribute it to the right person, and that’s it. It’s legal as long as you obey the rules of copyright. We didn’t take an NFT, just a picture.

So then what’s an NFT if it’s not an image or an in-game asset? The best way to explain it is that NFTs are a certificate of authenticity or ownership, like a deed to a house. The NFT proves that you own the image, even though the image is simply out there. The difference is that when you buy the house, the deed comes for free as a paper that determines proof of ownership.

An NFT is that proof without the asset. The smart contracts that govern your purchase and ownership are stored in your digital wallet and thus on a blockchain — usually the Ethereum blockchain — and are thus, theoretically, at least, safe from interference. That said, there are extra steps you can take to secure your NFT.

Digital Ownership

Their nature puts NFTs in a weird legal position. For example, if you were to buy physical art like a painting, and somebody then copied that painting without your permission, you could send the cops after them. If somebody were to copy your NFT, your recourse is a lot trickier and, as is explained in this article, heavily dependent on where you bought the NFT and that platform’s rules on copyright.

As shaky as that ground is, it gets worse: as revealed by The Verge, NFTs are even more watered down than a simple proof of purchase. You could argue that they’re not even a certificate of authenticity, merely a link to the server where digital files containing that link are stored. If that server were ever to go down, then you’d lose your certificate, too.

Rise and Fall of NFTs

With that in mind, you’d expect NFTs to be fun little curios that sell for a buck here or two bucks there, like kids’ trading cards. However, the price exploded thanks to the hype about NFTs being the next big thing. As a result, a lot of the people that probably felt like they missed the Bitcoin train jumped aboard NFTs.

To give you an idea of how crazy it got, a few Bored Apes went for more than $1 million each, with one going for just south of $3 million. Another artwork had 30,000 buyers shelling out almost $92 million for 300,000 pictures of essentially the same thing in just 48 hours. Having this kind of money flowing in made NFT projects pop out of the ground like mushrooms after a storm.

All manner of celebrities started offering NFTs: Kevin Hart offered an NFT collection based around his show on Roku, singer Grimes sold a digital artwork and even rapper Snoop Dogg got into the action, releasing visual and music-based NFTs in cooperation with Crypto.com, a leading crypto exchange.

If you were a journalist covering crypto from anywhere between mid-2021 to mid-2022, you woke up every day to an inbox full of hopefuls trying to make it in the NFT space. From major players and well-known celebs to struggling artists trying out a new avenue, everybody and their granny had an NFT out, it seemed.

From Boom to Bust

Of course, this massive bubble couldn’t last: they never do. Though it’s hard to pinpoint exactly what eventually caused prices to tumble in April 2022, the two best contenders for what ended this digital world of plenty are market glut and scams.

The market glut is simple to explain: with everybody getting in on them, the NFT marketplace just became saturated. After all, there’s only so many digital tokens anybody can buy, and buyers’ fatigue set in. It became harder and harder to sell NFTs, and prices started dropping. According to CNN, the average cost went down from $4,000 at the height of the market to about $1,400 a few weeks later.

However, this isn’t the whole story: the rest of the tale are the scams, and there were a lot of scams. Just like with cryptocurrencies, the amount of scamming that went on was ridiculous, with NFT marketplaces at times feeling like nothing more than a rogue’s gallery.

There are plenty of NFT scams around, but the biggest and likely most common is the so-called rug pull. Popular in crypto circles as well, it’s as simple as inviting people to invest in a brand-new opportunity, taking their money and then simply not delivering — pulling the rug from under their feet.

Examples abound: YouTube channel Coffeezilla has made a whole career of unmasking rugpullers and other NFT scams. Some of the biggest ones involve YouTube celebrity Logan Paul, who has twice not delivered on his promised NFTs, but there are plenty more. Many a promising digital artist turned out to be nothing but a jeering criminal behind a VPN.

Final Thoughts: A Future for NFTs?

Currently, there doesn’t seem to be much interest in NFTs outside of a small niche. Some of the people in that niche are collectors, though plenty more seem to be gamers caught in the P2E trap, trying to make a few bucks from their axies and other digital objects.

That said, there are some projects that are still doing well. Gary Vaynerchuck’s VeeFriends NFT collection seems to still be going strong, likely an indication of how devoted his fanbase is to the internet personality and entrepreneur.

Meanwhile, there seem to be small pockets of people here and there that seem to still be on the side of NFTs, looking for new uses for this technology and the killer app that will finally bring them back. Whether they will succeed is something that remains to be seen.

What do you think of NFTs? Did you participate in the craze, or let it pass you by? Do these digital tokens have a future, or are they no better than something Madoff might have dreamed up? Let us know in the comments below and, as always, thank you for reading.

FAQ

NFT stands for non-fungible token, which in turn means an asset, or token, that’s not interchangeable with others of its kind; it’s unique.

The use cases for NFTs are vague, at best. They have been used as digital artwork and as badges denoting club membership, as well as things like lottery tickets or even as digital IDs. Their main use now seems to be as collector’s items.

The question of whether NFTs are assets or art is entirely in the eye of the beholder. While many collectors will have bought NFTs as images to be admired, plenty more would have acquired purely as a way to speculate on a hot market. There’s also bound to be plenty of overlap between these two groups.

In their heyday, NFTs could go for millions, but now they trade for a lot less, sometimes even selling for pocket change.