Crypto Lawsuit: SEC Sues Coinbase & Binance in 2023

Heard that the SEC is suing Coinbase and Binance, but not sure why? Our crypto lawsuit explainer lays out the charges, likely outcomes and implications of the SEC’s boldest-yet action against crypto.

Key Takeaways: SEC Lawsuit Explained

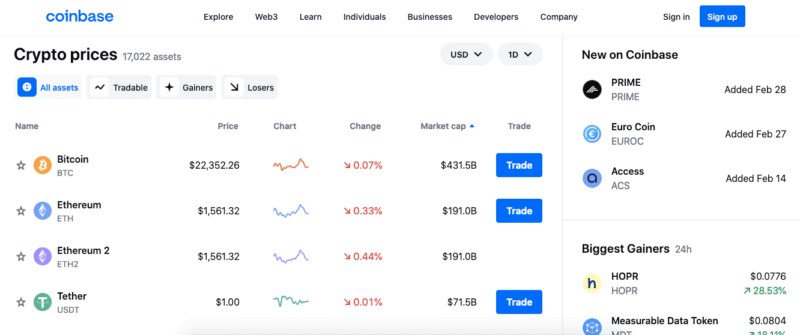

- The SEC is suing Coinbase and Binance for failing to register as securities exchanges. Coinbase and Binance argue that they have broken no laws because crypto assets are commodities, not securities.

- Federal securities laws in the United States are much stricter than those regulating commodities.

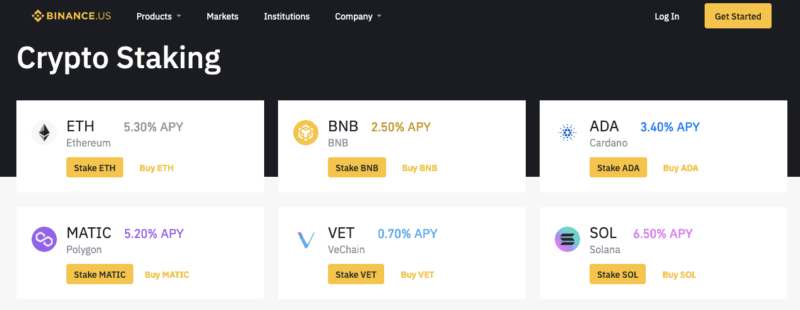

- Binance is additionally charged with operating simultaneously as a brokerage, exchange and clearinghouse, giving it the potential for the same market manipulations that caused FTX to fold.

- If the SEC wins the lawsuit, it could force crypto exchanges to submit to regulation, making crypto no longer a truly peer-to-peer alternative currency. If the exchanges win, crypto may affirm its freedom but become less attractive to average investors.

In June 2023, the Securities and Exchange Commission (SEC) — the United States government body charged with preventing fraud and exploitation in the stock market — filed suits against Coinbase and Binance, two of the world’s leading cryptocurrency exchanges. This crypto lawsuit has the potential to change the entire landscape of digital currency.

This isn’t the first time crypto exchanges have been targeted by SEC regulation, but with two of the world’s largest crypto businesses in the crosshairs, it’s a potential moment of reckoning. Depending on how the courts rule, this will either affirm the right to operate with minimal regulation or end the freewheeling era of crypto in the U.S. for good.

In this article, we’ll run down everything you need to know about the SEC crypto lawsuits: what they’re about, why they’re happening now, who the rulings will impact and more. If you need a refresher on digital assets before we start, check out our crypto for dummies overview.

What is the SEC Lawsuit About?

At its core, it’s a dispute over who has the right to regulate cryptocurrency. The Securities and Exchange Commission is suing Binance and Coinbase for failing to register and follow its rules. The defendants contend that they don’t have to register because their products don’t fall under the SEC’s authority.

The question hinges on the difference between securities (financial contracts with no inherent real-world existence, such as part ownership in a publicly traded company) and commodities (raw materials whose units are fully interchangeable, both spot-traded and used as the basis for futures contracts).

it’s a financial instrument or a real-world commodity.

The U.S. is the only country with separate regulatory apparatuses for securities and commodities. Commodities are regulated by the Commodity Futures Trading Commission (CFTC), while securities laws are enforced by the SEC, given authority by the Securities Act. Currently, cryptocurrencies such as Bitcoin are considered commodities, but the lawsuits may change that.

As the SEC is much stricter in enforcing its rules, especially under new SEC chair Gary Gensler, most crypto investors prefer the more permissive environment under the CFTC. However, Gensler has vowed to tame the “Wild West” of crypto, citing the 2022 crypto exchange crash and the fall of FTX as evidence that the cryptocurrency industry shouldn’t operate with impunity.

What We Know So Far About the Crypto Lawsuits

The Securities and Exchange Commission has sued crypto exchanges before — see our Kraken review and Gemini review for two examples. In both cases, the SEC argued that the exchanges were moonlighting as brokerages, which not only let them operate without protecting investors but gave them incentives to manipulate the market.

— imagine if Vanguard and the NYSE were the same entity.

As a result, both Kraken and Gemini no longer offer staking services in the United States. Other exchanges such as OKX (see our OKX review) have pulled out of the U.S. altogether, citing their fear of tightening regulations. These settlements give us a picture of how the current lawsuits may impact business for two of the world’s largest exchanges.

The lawsuits filed against Coinbase and Binance are more expansive than any previous crypto lawsuits, with each targeting the entire exchange as opposed to specific products it offers. With Coinbase, the SEC is arguing that it has failed to register as a securities broker, and thus is failing to protect customer funds in the way traditional exchanges must.

The lawsuit filed against Binance contains more serious charges. In a press release, Gensler accused Binance of having “engaged in an extensive web of deception, conflicts of interest, lack of disclosure and calculated evasion of the law” by combining a brokerage, exchange and clearing agency — essentially the same behavior that brought down FTX.

The Likely Outcomes of the SEC Lawsuits

It’s hard to say which way the courts will rule. Since crypto is such a new financial instrument, it’s difficult to classify as either a commodity or a security. Like a commodity, each crypto coin is fully fungible — that is, identical to every other instance of the same coin. However, currency is much more often regulated as a security when traded on the open market.

Both Binance and Coinbase say they’ll fight the charges, so we likely won’t see out-of-court settlements like we did with Gemini and Kraken. Instead, we may get a definitive ruling with serious implications no matter how the jury finds. Either outcome is likely to define how the U.S. treats crypto for a long time to come.

Staking in particular has faced SEC ire before.

If the courts side with the Securities and Exchange Commission, crypto companies may be forced to register as securities traders. This would bring crypto into the banking system and subject it to central authority, eliminating its main value proposition. Coinbase, for example, may no longer be able to operate as both an exchange and a brokerage.

On the other hand, if the courts side with the crypto exchanges, the crypto industry will have a legal justification for its unregulated status, and the “Wild West” atmosphere may continue for the foreseeable future.

In our opinion, the former is the more likely outcome, given that few crypto companies have even tried to fight the SEC so far. However, until the courts make a decision, there’s no way to know for sure.

What This Means for the Future of Exchanges

One important thing to note is that while these cases concern how the U.S. regulates the crypto industry, it’s not solely an American problem. Although most crypto exchanges are headquartered outside the U.S., and some (including Binance) have separate American exchanges, rulings in the U.S. still impact finance worldwide.

If you hold cryptocurrency, the outcomes of the Coinbase and Binance lawsuits are likely to affect you no matter where you live. In fact, they are already. Binance and Coinbase have collectively lost about $4 billion in volume since the lawsuits were announced, as jittery investors pull their money to safer exchanges.

if the lawsuits go badly for crypto exchanges.

In the long run, these lawsuits are about whether cryptocurrency can live up to its promise of creating a parallel financial world without a central authority. Crypto has been a double-edged sword since Bitcoin first blew up — on one hand, freedom, transparency and universal utility; on the other, a seemingly endless parade of scandals and market manipulations.

If the Securities and Exchange Commission wins, crypto risks becoming just another derivative in the traditional financial system, no longer able to trade freely peer-to-peer. However, if the exchanges win, they may no longer be seen as reliable guardians of customer funds. Either way, there’s a strong sense that decentralized currency is transitioning into a new era.

Final Thoughts

Crypto enthusiasts are an optimistic bunch by nature. Whichever way the Securities and Exchange Commission lawsuits go, some believe they’ll do crypto a favor simply by ending the uncertainty about impending regulation. The legal environment surrounding crypto has hitherto been far less transparent than the blockchain technology it’s built on.

According to Aaron Klein of Brookings, the current attitude in the crypto world is one of defiant positivity. Crypto traders point to the fact that nobody expected Bitcoin to change the world as much as it did, using the lackluster first flight of the Wright Brothers to assert that cryptocurrency has some surprises left to offer.

Either way, the bigger the case, the longer it takes, so the Coinbase and Binance lawsuits aren’t likely to yield results for some time. Until then, both exchanges plan to conduct business as usual. The main real-world impact will be more swings in crypto prices, which are already a lot more volatile than most traditional assets.

We’d love to hear from you as this story unfolds. If you own crypto, how have the SEC lawsuits affected you? Do you have any other questions? Let us know in the comments, and thanks for reading!

FAQ: SEC Sues Coinbase & Binance

The lawsuits filed in June 2023 target Coinbase and Binance.US, the American subsidiary of the larger Binance exchange.

It’s very difficult to predict what the price of crypto will do. However, if the courts rule in favor of the SEC, crypto may transform into a completely different, more regulated industry.

The SEC filed a lawsuit against Coinbase in June 2023. That said, it’s possible that the suit will end in a settlement out of court, as happened with Gemini and Kraken.