CBDC Meaning & Definition in 2025: Central Bank Digital Currencies Explained

Central bank digital currency (CBDC) is all online, but otherwise couldn’t be more different than cryptocurrency. Discover the CBDC meaning, what problems this new financial technology can solve and why some nations are reluctant to move forward.

Key Takeaways: CBDC Meaning

- A CBDC (central bank digital currency) is online money issued by a central bank like the U.S. Federal Reserve. Unlike cryptocurrency, it’s regulated by the government against price swings.

- Central banks are exploring CBDCs to remain relevant and reach unbanked citizens in the event that cash usage continues declining.

- The main drawback is that the unbanked people who would benefit most from CBDCs also tend to be the last to adopt new technology.

If you’ve heard of a central bank digital currency (CBDC) before, you might be confused about how it’s different from what we have now. After all, digital payments and banking are so common that we can go weeks without laying eyes on paper money. There’s more to the story, however, with CBDC meaning something altogether different than just digital funds.

In 2022, the United States Federal Reserve released a report titled Money and Payments: The U.S. Dollar in the Age of Digital Transformation, in which it floated the possibility of creating a new digital currency in the U.S. This currency would be valued and distributed by the Fed itself, making it a prime example of a CBDC — and pushing the concept into the mainstream.

In the age of cryptocurrency (see our crypto for dummies guide if you aren’t caught up), the push to digitize money has both technology and momentum behind it. Some CBDCs are even being actively implemented as you read this. Read on, and we’ll tell you what defines a CBDC, what benefits it provides and what obstacles remain.

Central Bank Digital Currency (CBDC) Meaning

A central bank digital currency (CBDC) is a form of legal tender that exists only as data and gets its value from the support of a central bank. The CBDC always has the exact same value as the central bank’s fiat currency.

Online commercial banks and other institutions have been using a digital form of money for a while, but the dollars in your digital bank account aren’t really currency. Those balances are known as commercial bank money. They represent a portion of the bank’s value that you have a claim on — more like a check than cash.

issued by the bank based on its own reserves.

In contrast, a CBDC is digital money with real fiat value. Holding a $5 bill doesn’t mean the Federal Reserve owes you $5; you just have $5. A CBDC has the same kind of inherent worth. That means it’s theoretically the safest possible kind of currency you can hold.

What Is a Central Bank?

A central bank is a bank that functions as part of a government and holds a monopoly on its country’s currency. The central bank is able to put new money in circulation and set interest rates. With these two levers, it can boost the economy or keep it from growing too quickly. Examples include the Federal Reserve, the Bank of England and the Bank of Japan.

Central banks took on increased importance with the rise of fiat currency, in which currency is backed by a country’s reputation instead of a physical commodity like gold. Practically all national currencies today are fiat money (nobody is still on the gold standard), so central banks like the Fed can control the value of money by deciding whether or not to issue more of it.

Most central banks don’t lend money directly to consumers or let them open accounts. They may lend to other financial institutions, but at high interest rates that ensure they’re only used as a last resort.

CBDC vs Cryptocurrency and Stablecoins

CBDCs are often confused with cryptocurrency, but the similarities are only surface-level. Both are digital currencies: money you need a computer to see or spend. Thanks to this, both enable rapid, low-maintenance transactions and move seamlessly across borders.

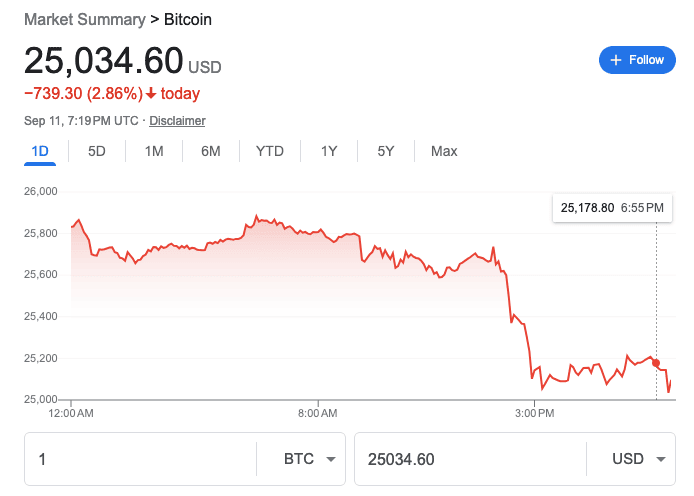

In all other respects, they’re exact opposites. The point of cryptocurrency is to be completely decentralized, with its value derived by consensus (see what is bitcoin for an example). The value of a crypto coin can often fluctuate wildly as a result, making it a potentially valuable but very insecure asset. There are also few opportunities to spend crypto in the real world.

dangers of relying on cryptocurrency to reach the unbanked.

A CBDC is about convenience and security, not big bets. It pegs its value to a physical currency specifically to avoid the kind of swings you get with crypto. It also doesn’t necessarily require blockchain technology to work — blockchain is a method of guaranteeing trust, but the authority of a central bank makes that unnecessary.

CBDCs are more like stablecoins, which also mimic the value of a fiat currency. However, stablecoins have no inherent value; they match other currencies by algorithmic workarounds that don’t always hold up. It’s essentially impossible for a CBDC to collapse unless the government backing it does.

Benefits and Drawbacks of CBDC

Although some CBDCs have already been implemented (see “active CBDC examples” below), many other countries are still weighing the pros and cons. Here are some arguments on both sides.

Benefits

The biggest case for CBDCs is that many people don’t have bank accounts, even in developed countries. These unbanked people are vulnerable to exploitation. Thanks to pawn loans, payday loans, check cashing stores and other predatory tactics, the poorest Americans have the highest debt-to-income ratios.

Imagine a future where the use of coins and paper money continues to decline. The more cash that leaves circulation, the fewer options unbanked people will have to spend money at all. An ideal CBDC promotes financial inclusion, giving people more ways to participate in the financial system without getting taken advantage of.

At the same time, it’s also a way back into relevance for the central banks themselves. Given how sharply the use of cash has dropped already, CBDCs could be the best way for institutions to bring policy to people in the future, instead of interacting entirely via private sector banks. This could also be in the public interest, as central banks have a much lower liquidity risk.

The Fed is quick to assure people that its hypothetical CBDC is not intended to replace cash. It would be just one payment method among many, hopefully filling holes in the system. You can think of it as a social safety net — a source of liquidity managed for the benefit of users instead of profits.

Drawbacks

Although there is a clear use case for CBDCs, not every country’s central bank agrees that the rewards justify the effort of development and implementation. The Bank of Canada is a prominent example. In 2021, Canada’s central financial institution decided there was not enough demand for a CBDC, though it’s still developing infrastructure in case that changes.

Canada clarified this stance in August 2023, saying that a digital representation of the Canadian dollar faced adoption issues from both the merchant and customer sides. The populations most in need of a CBDC — those at risk of becoming unbanked — also tend to be the most technology-averse and would likely be the last to adopt a fully digital coin.

There’s also a risk of cybercrime with any digital currency. Hackers would undoubtedly jump at the chance to steal real legal tender, so a CBDC would have to be protected by airtight security. It’s not just independent criminals, either. Nation-level actors regularly use cyberattacks to destabilize their enemies, and digital currency makes a tempting target.

Finally, the global financial system is so enormously complex that no one person understands the whole thing. It’s also largely powered by belief in abstract value. Any sweeping changes, such as a developed nation introducing a whole new currency, come with the potential for unexpected shocks.

Active CBDC Examples

Several countries around the world are already experimenting with CBDCs, with mixed results. The most prominent attempts so far show that mass adoption of a new digital currency requires significant investment in technology and the education of users and the general public.

The Bahamas: Sand Dollar

The Sand Dollar, a liability of the Central Bank of the Bahamas, is the first CBDC to be implemented on a national scale. To hold the money, users sign up for a digital wallet through their chosen financial institution. The easiest way to spend Sand Dollars is currently through a partnership with Mastercard that offers prepaid cards.

Nigeria: eNaira

The Nigerian eNaira is Africa’s first CBDC. The Central Bank of Nigeria had the same goals as the Bank of the Bahamas: to reach the unbanked and make cross-border payments easier. Unfortunately, both currencies have been slow to catch on; many users are unsure how to onboard and suspicious of the inherent lack of privacy.

China: e-CNY

Since China is one of the few countries where crypto is illegal, it’s interesting to see it among the pioneers of a digital version of currency. The electronic form of the yuan (e-CNY) was developed in part because mobile payment methods are growing rapidly in China — in 2022, Chinese people made over 40% of payments through smartphone apps.

Because credit and debit cards never took hold in China like they did in the U.S. and Europe, reaching the unbanked is even more difficult. Foreigners also have trouble making mobile payments. This presents several strong use cases for a CBDC, but even so, market penetration has been sluggish. Only about 0.1% of yuan currently in circulation are digital.

The Eastern Caribbean Currency Union

The Eastern Caribbean Currency Union (ECCU), an economic league consisting of several small island nations in the Lesser Antilles, launched DCash in 2019. Though it’s hard to find statistics on DCash adoption, we do know about some of its struggles: In 2022, the currency crashed and became inaccessible for about two months.

Sweden: e-krona

Sweden’s e-krona is the first CBDC to be seriously explored in Europe (not counting a brief experiment by Finland in the 90s). Its Riksbank launched the e-krona project for the same reason as most other central banks — to help those who may be left behind by a cashless society.

However, a 2023 report by a government panel suggested that the e-krona isn’t yet necessary, putting its future in doubt.

Final Thoughts: Government CBDC

Although some countries are forging ahead with CBDC projects, the dominant mode of thought seems to be “hurry up and wait.” The nations like China and the Bahamas that have launched digital currencies are seeing slow adoption. Others, like Canada and Sweden, have considered and rejected CBDCs as not yet necessary.

The future of CBDCs depends on how quickly cash actually declines. The more people find they can’t buy things with cash, the more pressure there will be for a solution. On the other hand, if rumors of cash’s death are exaggerated, the use case for CBDCs remains too niche to be worth investing in.

Have you used a CBDC? What do you think of the concept? Tell us in the comments. Thank you for reading.

FAQ: CBDC

A central bank digital currency (CBDC) is an online-only form of money controlled by a government national bank. Its value is always equal to that of the issuing country’s traditional currency.

A CBDC gives governments more opportunity to reach unbanked people. In a cashless society, the CBDC would let everyone with internet access get a hold of financial resources without having to go through predatory or profit-motivated third parties.

No, CBDC is not cryptocurrency. Crypto is decentralized and managed through blockchain ledgers, while a CBDC is controlled by a central authority.