Project Management in Finance: Strategies, Best Practices & Career Opportunities in 2025

Project management is more than assigning tasks to team members and tracking them; it's about managing budgets and appeasing stakeholders, too. Project management in finance is a critical part of project management, and we’ll explore it in detail in this article.

For project management in finance, finance managers or project managers must formulate budget estimates, manage resources, identify risks, track budgets, avoid scope creep, and update stakeholders and clients. Though it might sound easy, we can assure you it’s not.

If a career in finance project management interests you, stick around. We’ll explain financial project managers’ role, their responsibilities and the common challenges that finance managers face. We’ll even show you some of the best project management software and explain how you can become a finance project manager. Let’s jump right in.

Introduction to Project Management in Finance: Why Is It Important?

Project management is more than just scheduling tasks and assigning team members to jobs; it’s also about managing finances, which includes monitoring costs, earnings and losses; keeping track of bills; and constantly estimating where a project is in terms of funding.

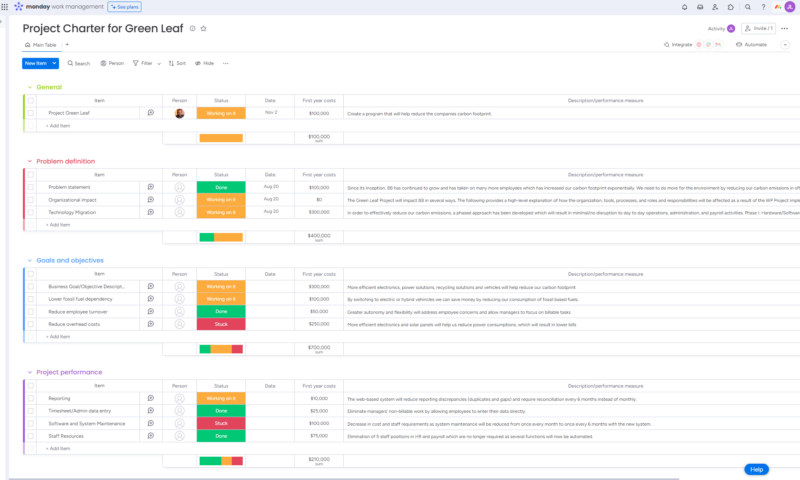

If you start a project without first estimating budgets in a project charter, you’ll be in for a rough time. Without budgets and budgeting, a project can spiral out of control financially and quickly become a victim of scope creep. Finance management in projects is crucial to getting a good return on investment (ROI) and appeasing stakeholders and clients.

The Role of Financial Project Managers

Most projects have a dedicated financial manager who tracks costs, but sometimes this responsibility falls on the project manager. However, no matter who controls the purse strings, the financial manager, project manager or scrum master will have a vital role to play. Those in charge of tracking money are in control of the areas listed below:

- Project planning: A financial manager plays a key role in project planning. Finances should be discussed while the project charter is being created, and the finance manager should set project estimates.

- Resource management: Resources, including people and project items, cost money. A financial project manager must carefully select where to procure resources and consider wages when picking a team.

- Financial management: Those in charge of the coffers should constantly monitor budgets and expenses. Fortunately, many of the best free project management software platforms have budgeting features or can at least integrate with financial platforms.

- Communication: Finance managers must constantly communicate with stakeholders and clients about finances and how the project is going in order to discuss budget issues or requests for more money.

- Project monitoring: The fourth stage of every project lifecycle is the monitoring phase. During this time, managers must monitor expenditures, the costs of goods, salaries and more. Any issues need to be rectified as soon as possible.

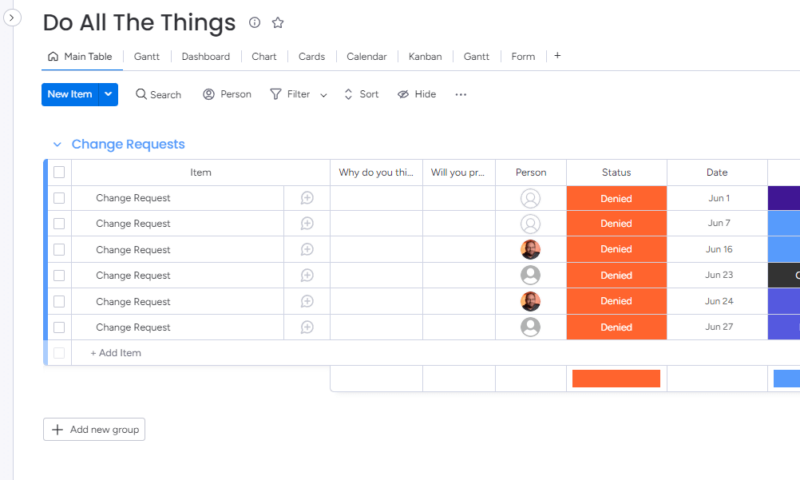

- Implementing stakeholder changes: It’s not uncommon for stakeholders and clients to request changes. Changes are fine, but they must follow an approval process that involves the managers discussing the feasibility and extra budgeting to pay for additional work. If these requests are not discussed, scope creep becomes a real possibility.

The Benefits of Project Management Software in Financial Planning

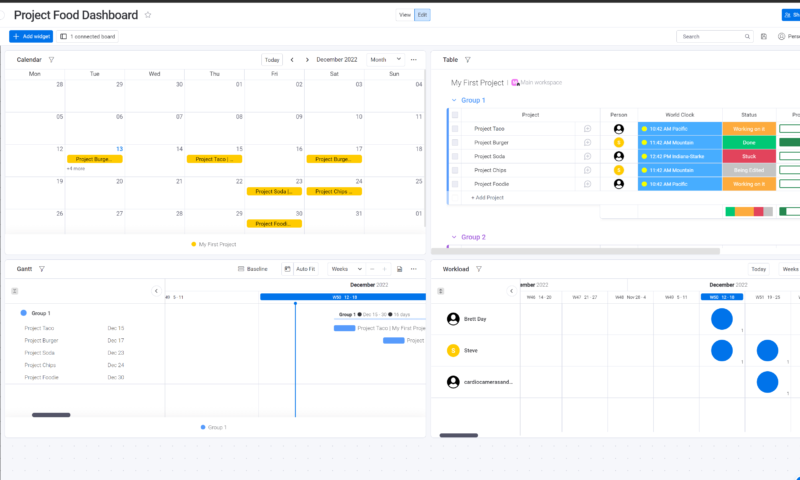

Modern project management software not only lets leaders assign and track tasks but also allows them to enter financial details and track budgets in dedicated sheets, reports or customizable dashboards. Below, we’ll cover the key benefits of using project management software for financial planning and effective project management.

- Improve resource management: Project management software platforms allow managers to easily monitor resources. Worker efficiency, total hours worked on a task, total expenditure and costs of goods can all be entered and monitored.

- Prioritize high-return projects: Monitoring projects will help you better understand which projects are yielding the best ROI. By determining which projects are performing better, you can move resources to the jobs that will be more profitable.

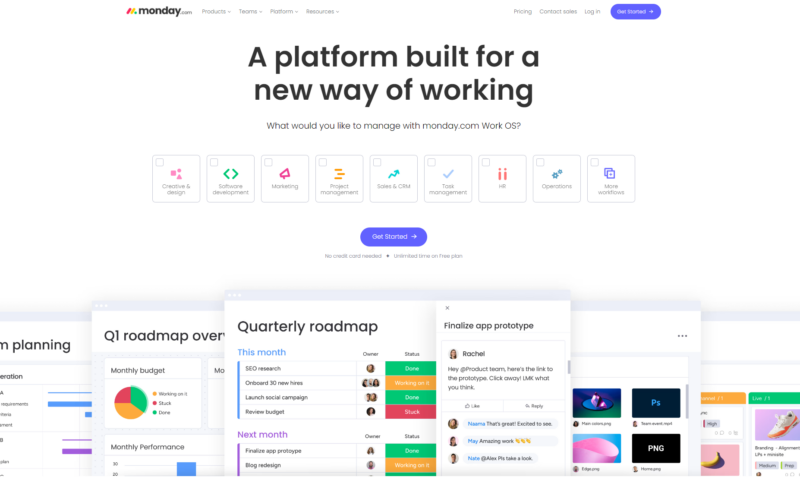

- Keep projects moving forward: One key reason to use project management software is to track tasks and overall project performance. Software like monday.com can help keep projects on track, which means you’ll have a better chance of finishing the work before the project deadline and stay on or under budget.

- Keep scope creep at bay: Thanks to detailed budget sheets, reports and budget planning templates, it’s easier than ever to monitor project costs and deadlines. Use the tools at your disposal to ensure tasks are finished on time and that the budget remains in the green to avoid scope creep.

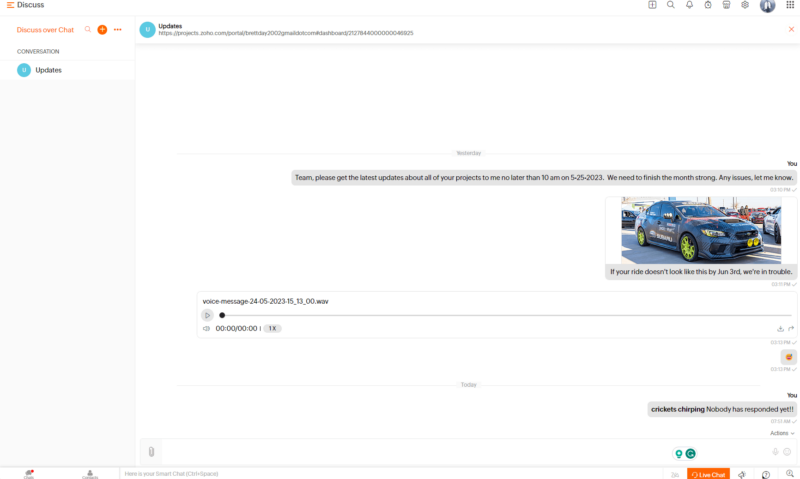

- Improved stakeholder relationships: Modern project management tools include powerful real-time chat and collaboration tools. It’s easy to quickly send messages, hold real-time meetings and create documents that support projects with stakeholders and clients.

Common Challenges in Financial Project Management

We know that project leads always do their best to ensure a project’s finances are in good shape and that the overall financial health is where it needs to be. However, not knowing some of the most common challenges in managing project costs can lead to disaster. Below, we’ll look at some challenges that could derail financial performance.

Managing Project Expenses, Scope and Cost Overruns

- Poor risk management: Understanding risk is crucial to managing financial resources. During the project planning stage, managers must identify potential risks and implement plans to deal with issues should they arise. Being proactive instead of reactive can help avoid unexpected expenses.

- Inconsistent data: Managing project financials correctly will be nearly impossible if the data you receive is inconsistent. Ensure the financial data that stakeholders and clients send you is correct, double-check data entered into software and pay close attention to project profit, loss, total project costs and resource expenditure.

- Incorrectly tracking project financials: Utilize the budget templates, reports and dashboards in your chosen software to track direct costs, labor costs, actual costs, the cost performance index and other financial metrics that help manage finances. Don’t use methods that can lead to costly mistakes. Post-it notes can only do so much.

- Following unimportant metrics: Though reports can help track progress, they’re often filled with information that might not be important to you and your role. Only use information specific to project finances and not the entire team.

- Weak project charter: Creating a robust project charter that aligns with your business’s strategic goals is crucial. Poor task planning, improper identification of required resources and poor project budget planning will hinder project success. Slow down, take your time and carefully plan for your projects.

- Scope creep: Proper project finance management is crucial to avoiding scope creep. Scope creep occurs when managers fail to track finances or allow changes to the project charter without accounting for them, and when teams are inefficient and constantly deliver tasks past their due dates.

- Economic issues: We cannot control the markets, but if we ignore resource costs, actual costs could skyrocket beyond the budget. Carefully monitor resource allocation needs and communicate with your team and stakeholders if cost increases occur. If you’re not careful, your resource management capabilities will diminish.

- Poor communication: Poor communication leads to many issues. As a project leader, you should hold daily meetings or individual meetings with team members, stakeholders and clients to touch base and discuss how the project is progressing.

- Poor cash flow: If a project experiences poor cash flow, leaders must contact their finance department to discuss expenses and determine whether there is extra room in the budget, especially if the original scope of work has been altered from the submitted project charter.

to track feature changes from stakeholders and clients.

Tips & Best Practices for Risk Management and Mitigation in Project Financial Management

1. Effective Planning, Budgeting and Scheduling

Creating a project charter will help you avoid planning, budgeting and scheduling issues. The tips below will help you avoid potential financial disasters.

- Plan finances in advance: Plan your project finances meticulously. Perform market research, identify costs of goods and plan for your team members’ salaries, software costs and more. Present the budget estimate and project plan to stakeholders and clients to determine the feasibility.

- Always have a safety net: A project will always have risks. The project manager’s job is to identify potential issues and formulate a plan to deal with them should they arise in order to minimize damage to the project’s schedule. Many project management software platforms allow you to quickly create and share risk assessments.

- Schedule regular reviews of project progress: Ensure you’re staying on top of your project by checking key performance indicators (KPIs) every day. Modern software makes this easy thanks to dashboards, reports and automations that can alert you to issues should they occur.

- Minimize and keep on top of scope creep: We cannot stress enough how important it is to prevent scope creep. Track expenses, make sure your team meets deadlines and account for any requested changes to the project’s scope. If extra work is required, ask for an increased budget.

custom dashboards to track project progress and budgets.

2. Project Management Software for Financial Management and Reporting

We’ve talked about software that can help you manage projects, and now it’s time to share the platforms that our experts fully endorse. The platforms listed below are complete project management suites, which means they can track projects and replace or integrate with many project accounting software platforms.

- monday.com — monday.com is the best project management option for most. It is user-friendly; offers various workflow views, reports, budget templates and communication tools; and can track multiple projects. Learn more in our monday.com review.

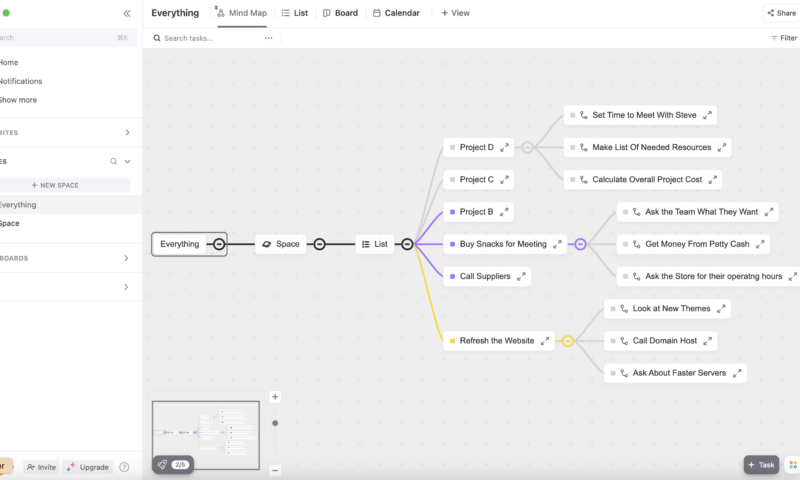

- ClickUp — With its suite of real-time collaboration tools, ClickUp helps managers effortlessly stay in touch with stakeholders. ClickUp tracks projects, offers timesheets and budget templates, and has customizable dashboards. Read more about it in our ClickUp review.

- Zoho Projects — Thanks to integrations with Zoho products, Projects is one of the most versatile platforms around. You can create budgets, track tasks, manage resources, view reports and chat in real time. Our Zoho Projects review has more details.

- Wrike — If you’re after detailed reports and powerful project and budget tracking, Wrike is for you. Wrike is easy to use, offers enterprise-grade security features, makes financial tracking easy and can scale to enterprise-wide projects. For more details, see our Wrike review.

thanks to its ease of use and robust features.

3. Keeping Stakeholders Engaged and Informed

Communication is the key to project success. Keep the following tips in mind as you head into a project and you’ll be able to generate relationships with stakeholders and clients.

- Openly communicate — Have frequent, transparent chats about the project, how it’s going, potential problems and whether there are any budget issues. Open communication will build trust between you, stakeholders and clients.

- Involve stakeholders in meetings — Real-time collaboration tools will help you involve stakeholders and clients in team meetings. Ask them to participate, offer feedback and share any concerns so the entire team is on the same page.

- Don’t be afraid to ask questions — If you’re unsure about feedback you’ve received or requests that someone has made, ask questions. One surefire way to get yourself into a pickle is to assume you know what’s expected of you and your team.

make sharing project plans with stakeholders easy.

How to Become a Financial Project Manager

If you want to become an expert in project financial management, this section will interest you. Many positions require a bachelor’s degree in accounting or business management, project management experience and some of the best project management certifications.

To increase your chances of becoming a finance manager for a project team, you should take a look at these certifications from the Project Management Institute:

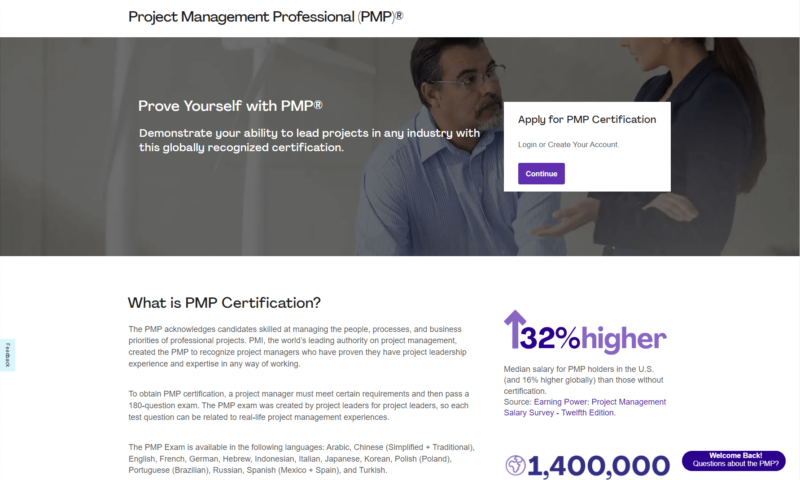

- PMI-PMP (Project Management Professional) — The PMI-PMP is a globally recognized project management certification that shows you have the knowledge to lead projects of all types and that you have a deep understanding of multiple project methodologies.

- PMI-CAPM (Certified Associate in Project Management) — PMI’s Certified Associate in Project Management is the ideal certification for those who want to embark on a career in project management. Like the PMI-PMP, the PMI-CAPM will show employers you have the knowledge and skills to lead a variety of projects.

- PMI-RMP (Risk Management Professional) — The PMI-RMP certification shows you have what it takes to identify project risks and that you know how to mitigate them.

manage every facet of a project from beginning to end.

Final Thoughts

As you can see, leaders deal with many expectations regarding project financials. You need to be keenly aware of the markets, potential risks and stakeholder expectations, as well as what it takes to prevent scope creep. You need to be able to track projects, and be an excellent planner and communicator. It’s also important to be willing to embrace project management software to ensure success.

If you want to pursue a career as a finance manager, you need to gain project management experience and obtain certifications from globally recognized schools to get started. What do you think about our guide? Did it help you understand the importance of finance management in projects? Let us know in the comments, and as always, thanks for reading.

FAQ: Finance Project Management

Finance project management is the process of analyzing and monitoring a project’s finances. It also involves risk management, collaboration with stakeholders and clients, and resource management.

Yes! Though a project manager is often responsible for managing and monitoring project finances, accountants or CFOs can also manage projects. These positions usually require the manager to hold a PMP certification, which proves they know how to run projects successfully.

A project manager or finance manager is responsible for creating project budget estimates; obtaining resources; tracking income, expenditures and markets; and ensuring that tasks are completed on time and within budget to avoid scope creep.

Most positions require financial project managers to hold a business, accounting or economics degree; hold project management certifications like the PMI-PMP; and have significant experience managing projects.